Gold price trends experienced a decline on Wednesday as traders began selling in response to recent signals from the Federal Reserve. The central bank’s hawkish stance, revealed in its latest meeting minutes, suggests that it will maintain tight monetary policies. This has led to a stronger US dollar, making gold less appealing to investors.

Gold traders are now closely monitoring key economic indicators in the US. These include the performance of manufacturing and service sectors in May. Weak data could prompt expectations of lower interest rates, which might support gold prices. Additionally, global geopolitical tensions, inflationary concerns, and uncertainties may keep gold prices from falling sharply in the near term. Critical data, such as Chicago’s economic activity, weekly jobless claims, new home sales, and statements from Federal Reserve member Bostic, are also on the radar.

Key Factors Impacting Gold Prices

Federal Reserve’s Policy and Economic Data

The Federal Reserve’s recent actions play a crucial role in shaping gold prices. The release of the Federal Open Market Committee (FOMC) meeting notes highlighted concerns about inflation, which has not yet hit the target rate of 2%. Despite the slight reduction in inflation over the past year, the Fed remains cautious about lowering interest rates, as steady economic growth is still evident.

The market currently anticipates a 60% chance of an interest rate cut by September, according to the CME FedWatch Tool. If these cuts take place, with two expected reductions of a quarter percentage point each by the year’s end, it could positively impact gold prices. Key data to watch includes the US S&P Global Manufacturing and Services PMI for May, which are expected to remain at 50.0 and 51.3, respectively.

On the global front, the People’s Bank of China (PBoC) continues to be a significant buyer of gold. Over the past year, it has added 225 tonnes of gold to its reserves, marking the largest purchase since 1977. This ongoing acquisition could offer long-term support to gold prices.

Gold Price Trends and Technical Analysis

Gold prices may have dipped recently, but the overall trend remains positive on the daily chart. Prices are still above the 100-day Exponential Moving Average (EMA), indicating potential bullish momentum. The 14-day Relative Strength Index (RSI) is holding firm at 56.10, showing that buyers are still in the market.

However, there is a risk of a bearish divergence. This technical signal occurs when prices reach new highs, but the RSI does not, suggesting that momentum could be weakening. If gold rallies, it might face resistance near the $2,450 level, which is a previous high and the upper boundary of the Bollinger Band. A breakout beyond this could push gold to $2,500, a significant psychological threshold.

On the downside, gold has support around $2,332, a recent low from May. If the price continues to decline, it could test the $2,270 mark, which corresponds with the lower Bollinger Band boundary. A fall below this point may lead to further losses, with the next support at the 100-day EMA around $2,216.

USD Performance and Its Impact on Gold

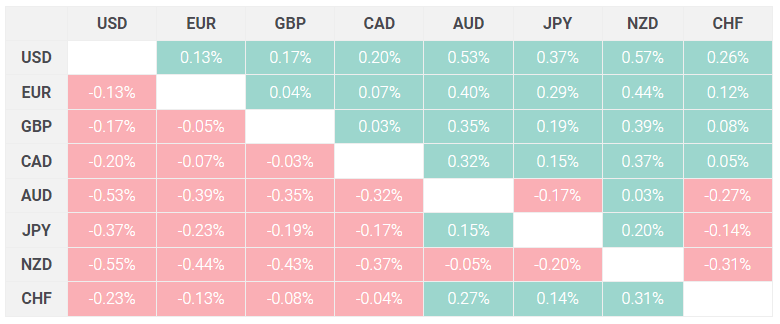

The strength of the US dollar (USD) also heavily influences gold prices. Over the past week, the USD has shown strong performance, especially against the Swiss Franc. This rise in the dollar tends to pressure gold prices as gold becomes more expensive for holders of other currencies.

The currency heat map provides insights into how the USD has fared against other major currencies. For example, if the Euro is chosen as the base currency and compared to the Japanese Yen, the percentage change between the two is displayed.

Conclusion

Gold prices are currently under pressure due to the Federal Reserve’s hawkish stance, which has strengthened the US dollar. However, various factors, such as potential economic weaknesses, inflationary pressures, and geopolitical tensions, could provide support for gold in the near future. Traders should keep an eye on key economic indicators and central bank decisions that could influence gold’s direction.

For more insights on gold price trends and updates, visit Daily Gold Signal for internal links, and check out the Daily Gold Updates for more detailed analysis and reports.