Gold price update experienced a significant rise on Tuesday after bouncing back from their two-week low of $2,325. This recovery is largely attributed to a weakening US Dollar and heightened demand for safe-haven assets, fueled by ongoing tensions in the Middle East. Investors are closely watching how economic indicators will impact the market moving forward.

Gold Price Boosted by Weak US Dollar

The dip in the US Dollar has played a critical role in supporting gold price update. When the dollar weakens, it makes gold—a dollar-denominated asset—more affordable for holders of other currencies, boosting demand. Rising geopolitical tensions have also prompted investors to seek safer investments like gold.

Rising Treasury Yields: A Risk to Gold Prices?

On the flip side, short-term US Treasury yields have been climbing. This is due to expectations that the Federal Reserve may raise interest rates soon, as hinted by the latest meeting minutes. These rising yields could strengthen the US Dollar once more, potentially dampening the upward momentum of gold prices.

Key US Data in Focus

With several important US economic data releases scheduled, including Friday’s Core Personal Consumption Expenditures Price Index (Core PCE), traders are hesitant to make major moves. The Core PCE is a key measure of inflation that could influence the Federal Reserve’s future decisions on interest rates. Additionally, the US Consumer Confidence report will be published on Tuesday, alongside speeches by Federal Reserve officials, Neel Kashkari, Mary Daly, and Lisa Cook. Any signals from them about potential interest rate hikes could shift market sentiment, impacting both the US Dollar and gold prices.

Market Digest: Impacts of Global Tensions and Economic Trends

International events, like the recent Israeli attack on Gaza, have further driven global uncertainty. As tensions escalate, many world leaders are calling for a halt to the violence, adding to the demand for gold as a safe-haven asset.

At the same time, economic data out of the US is contributing to market uncertainty. The first estimate of US GDP growth for the first quarter is 1.4%, slightly below the previous estimate of 1.6%. If upcoming data points, like the Core PCE, show strong economic performance, traders may adjust their expectations regarding the timing of any rate cuts by the Federal Reserve.

Gold Price Technical Outlook

From a technical analysis perspective, gold continues to show a long-term positive outlook. The 1-hour chart indicates that gold remains above the critical 100-day Exponential Moving Average (EMA), suggesting continued upward momentum.

The 14-day Relative Strength Index (RSI) is currently neutral, indicating a balance between buyers and sellers. However, if the price moves past the upper Bollinger Band at $2,430, further buying could push the metal toward new highs of $2,450 and potentially $2,500.

On the downside, if gold prices start to fall, the first support level is around $2,300. A drop below this could lead to further declines, targeting $2,268 and then the 100-day EMA at $2,220.

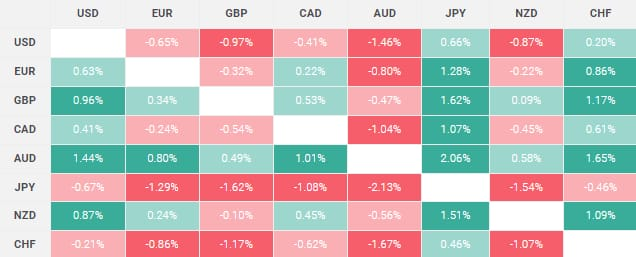

The US Dollar and Global Currencies: Current Overview

Today’s chart highlights the US Dollar’s relative weakness against other major currencies, particularly the Australian Dollar. The heat map showcases percentage changes between key currencies, offering insights into the strength and weakness of each. For instance, the Euro has shown notable shifts against the Japanese Yen, reflecting ongoing currency volatility.

Conclusion

The current dynamics in the gold market, driven by a weaker US Dollar and ongoing global tensions, provide an exciting yet uncertain outlook. As investors await key economic data and Federal Reserve updates, the future of gold prices remains highly dependent on inflation trends and potential interest rate hikes. For regular updates on gold prices and trends, visit Daily Gold Signal. Stay informed with the latest daily gold updates by checking out this gold update section.