Gold price decline (XAU/USD) are experiencing a decline today, primarily due to a stronger US Dollar (USD) and increasing US yields. This downward trend is driven by the reduced likelihood of a Federal Reserve (Fed) rate cut this month, which is intensifying the selling pressure on gold. As investors await the second estimate of the US Gross Domestic Product (GDP) for Q1 2024, gold’s future remains uncertain. If the US economy performs better than expected, the USD could gain strength, further impacting gold prices. However, rising geopolitical tensions and growing central bank demand could offer some support for gold.

Market Overview: Impact of Stronger US Data

Geopolitical Tensions and ETF Outflows

On Wednesday, the Israeli military took control of the Philadelphi Corridor, a 14-kilometer strip along the Gaza-Egypt border, as reported by CNN. Additionally, global gold ETFs experienced a significant outflow of 11.3 metric tonnes last week, according to the World Gold Council.

Fed’s Influence and Market Predictions

Fed Atlanta President Bostic stated that while price increases are still widespread, reduced inflation could potentially lead to a rate cut. The Fed’s Beige Book, released Wednesday, highlights modest economic growth and rising prices from early April to mid-May. However, uncertainty and risks have led to a more pessimistic outlook.

Currently, markets predict a 50% chance that the Fed will keep interest rates unchanged in September, based on the CME FedWatch Tool. The US GDP for Q1 2024 is expected to grow at an annual rate of 1.3%.

Technical Analysis: Gold Price Outlook

Short-Term Trends and Indicators

Today, gold price decline are trading with a negative bias. On the 1-hour chart, gold remains bullish as long as it stays above the key 100-day Exponential Moving Average (EMA). However, the 14-day Relative Strength Index (RSI) is around the neutral 50 level, indicating uncertainty between bullish and bearish trends.

Price Targets and Support Levels

If gold prices rise above $2,425, they could approach the all-time high of $2,450. A break above this level might lead to reaching the psychological milestone of $2,500. Conversely, if the price declines, initial support is expected around the low of $2,325 from May 24. Further support levels include $2,300, $2,284 (lower Bollinger Band), and $2,227 (100-day EMA).

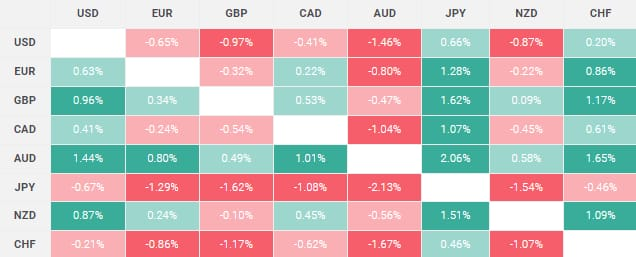

US Dollar Performance Today

The table below displays the percentage change of the US Dollar (USD) against major currencies today. The USD has shown the strongest performance against the New Zealand Dollar. The heat map illustrates these percentage variations, with each cell showing the change between the base and quote currencies.

Conclusion

For more detailed analysis and updates on gold prices and market trends, visit Daily Gold Signal. For daily updates on gold, check out the Daily Gold Update. Stay informed to navigate the fluctuating gold market effectively.