Gold price represented by XAU/USD, have experienced some downward movement, with prices settling in the $2,316-2,315 range. This marks a slight decline from a multi-week low reached recently. The drop in gold prices has been influenced by a modest strengthening of the US Dollar (USD), which saw some recovery from a two-month low. However, this rebound in the USD lacked significant momentum due to expectations that the Federal Reserve (Fed) might cut interest rates later in the year.

US Dollar Rebound and Its Effect on Gold

The Fed’s potential interest rate cut has been a result of weak US macroeconomic data, which has kept US Treasury bond yields relatively low. Gold, being a non-yielding asset, benefited from this during the European trading session on Wednesday. Furthermore, geopolitical tensions in the Middle East have added to the upward pressure on gold prices, pushing them closer to the 50-day Simple Moving Average (SMA).

Range-Bound Gold Prices Amid Investor Caution

Despite these positive factors for gold, XAU/USD remains stuck in a narrow trading range that has persisted for about a week. Investors are hesitant to make bold moves, awaiting the release of significant US employment data, particularly the Nonfarm Payrolls (NFP) report scheduled for Friday. This cautious approach indicates that the market is looking for clearer signals before committing to any major positions.

Gold Price Dynamics: Support and Resistance Levels

From a technical perspective, gold prices have fallen below the 50-day SMA, which suggests potential for further declines. Oscillators on the daily chart indicate negative momentum, increasing the likelihood of additional drops. If gold prices fall below the recent low of $2,315-2,314, it could confirm a bearish trend, potentially driving prices down to the $2,300 level and testing the $2,280 support.

On the upside, gold faces significant resistance around the $2,349-2,350 zone. Breaking through this level could push prices toward $2,385 and possibly even $2,400. If the bullish momentum continues, gold may climb further toward the $2,425 zone, with potential to reach the all-time high near $2,450.

US Dollar Movements and Their Influence on Gold

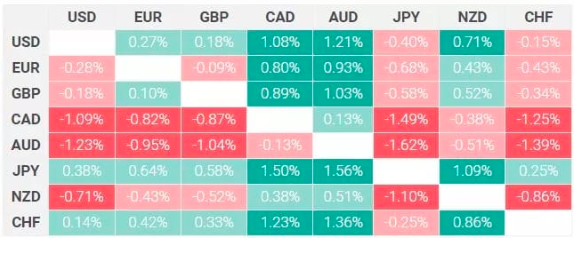

In recent days, the USD has seen slight gains against major currencies, as shown in the heat map below. However, this recovery has not been enough to significantly impact gold prices, which remain supported by expectations of a Fed rate cut and lower bond yields.

Conclusion

The gold market remains cautious as investors await crucial US economic data, particularly the Nonfarm Payrolls report. While the US Dollar’s recovery has put some pressure on gold, expectations of a Fed rate cut and geopolitical risks continue to provide support. Investors are advised to monitor the upcoming data releases closely, as they will likely influence gold’s next move.

For more detailed insights and updates, you can visit the Daily Gold Signal website. For further updates on gold market trends, check out the Daily Gold Update section.