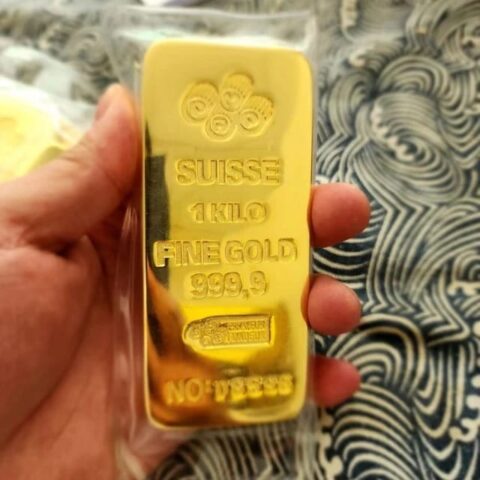

The Indian gold prices witnessed a significant uplift on Wednesday, with gold prices reaching new highs. According to FXStreet, the price of gold per gram in India rose to 6,247.90 Indian Rupees (INR). This marks a notable increase of INR 7.78 from Tuesday’s price of INR 6,240.12. Similarly, the price of gold per tola also saw an increase, climbing to INR 72,874.29 from the previous day’s rate of INR 72,783.58.

Gold Price Analysis: A Detailed Breakdown

- 1 Gram of Gold: The price per gram surged to INR 6,247.90.

- 10 Grams of Gold: The cost for 10 grams climbed to INR 62,479.28.

- Price Per Tola: Gold per tola increased to INR 72,874.29.

- Troy Ounce Price: Gold prices for a troy ounce hit INR 194,331.60.

This trend showcases the growing demand and the upward momentum in the Indian gold market.

Global Factors Impacting Gold Prices

The global market dynamics also played a role in shaping the gold prices. The US Dollar strengthened slightly after hitting a two-month low, which exerted downward pressure on the Comex Indian gold prices. Despite this, weak US economic data prevented significant losses.

The Job Openings and Labor Turnover Survey (JOLTS) reported a larger-than-expected drop in job openings, falling by 296,000 to 8.059 million in April. This marks the lowest level seen in over three years. Additionally, the US ISM Manufacturing PMI data released earlier in the week revealed a slowdown in business activity, signaling a cooling of the US economy.

Economic Concerns and Future Predictions

Concerns are mounting about the US economy weakening more than expected. This has fueled speculation that the Federal Reserve may cut rates in September. This anticipation has also led to a drop in US Treasury bond yields, including the two-year government bond and the benchmark 10-year Treasury yield. These factors have limited the US Dollar’s strength, which, in turn, has supported gold as a non-yielding asset.

Upcoming Economic Events to Watch

Traders are keeping a close eye on the upcoming ADP report on private-sector employment and the ISM Services PMI, both scheduled for release on Wednesday. These reports are expected to create short-term trading opportunities. However, the key focus remains on the Nonfarm Payrolls report, which will provide critical insights into the US employment landscape and will be a significant factor in determining the next movement of the XAU/USD pair.

Conclusion

The Indian gold market is currently experiencing an upward trend, driven by both domestic and global factors. As traders and investors look for short-term opportunities, the upcoming economic reports will play a crucial role in shaping future gold prices. For the latest updates on gold prices and market analysis, you can explore more insights on Daily Gold Signal and stay informed with the Daily Gold Update.