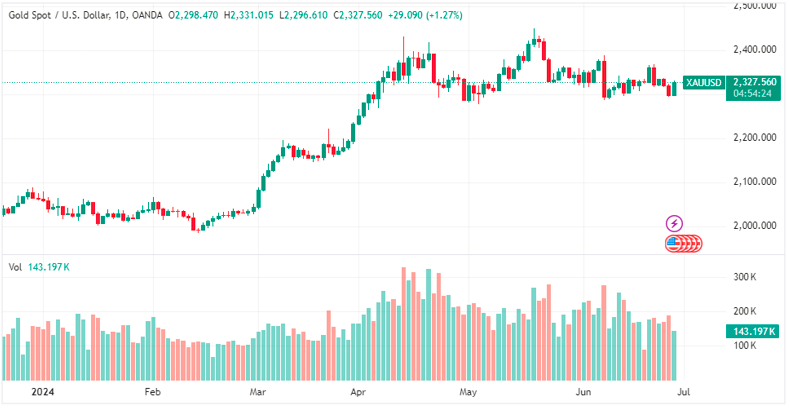

Gold prices forecast have slightly increased as traders engage in light short-covering before significant U.S. economic reports. The market also attracted bargain hunters after Wednesday’s sell-off, which didn’t break key support levels like the June 7 low at $2286.83. Additionally, a weakening U.S. Dollar against a basket of major currencies supported gold.

Focus on U.S. Economic Reports

Market participants eagerly await Friday’s U.S. inflation data, which might affect the Federal Reserve’s next interest rate decision. Before this, several key economic reports relevant to the gold prices forecast are due on Thursday, including weekly jobless claims, durable goods orders, and pending home sales.

Economists forecast that jobless claims for the week ending June 22 will rise to 240,000 from the previous week’s 238,000. Durable goods orders are expected to have dropped by 0.6% in May, reversing the 0.6% increase seen in April. Pending home sales are anticipated to have increased by 1% in May, following a significant 7.7% decline in April.

Treasury Yields and Economic Outlook

U.S. Treasury yields rose on Thursday as investors examined economic data for insights into the economy and monetary policy’s future. These reports follow data showing an 11% drop in new home sales in May. On Friday, the personal consumption expenditures (PCE) price index, which is the Federal Reserve’s favored measure of inflation, will be released. The Fed’s decisions on interest rates depend significantly on inflation trends and whether they are moving sustainably towards the central bank’s 2% target.

Impact of Interest Rates on Gold

Fed Governor Michelle Bowman reiterated that inflation would continue to decline if the policy rate remains steady. However, she also mentioned the possibility of additional rate hikes if progress on inflation stalls or reverses. Traders are currently pricing in a 62% chance of a rate cut in September, according to the CME FedWatch Tool.

Gold remains supported by a moderating U.S. dollar, with dips below the $2,300 level proving temporary since April. However, if the Federal Reserve’s rate cut prospects diminish, gold bulls might struggle to maintain prices above this psychological threshold.Lower interest rates reduce the opportunity cost of holding non-yielding bullion, thereby making gold more appealing.

Geopolitical Tensions and Gold Prices

Geopolitical tensions, especially in the Middle East, where cross-border strains between Israel and Lebanon’s Hezbollah have been escalating, could further influence gold prices. The potential for a conflict involving regional powers adds to the market’s uncertainty.

Market Forecast: Bullish Outlook for Gold

Given the current economic and geopolitical landscape, gold is expected to maintain a cautiously bullish outlook in the short term. However, the technical outlook indicates potential weakness. Optimism is cautiously supported by a weakening dollar, ongoing geopolitical tensions, and the possibility of a dovish change in Federal Reserve policy. Traders need to closely watch upcoming economic data and Fed communications to assess future price movements, as any unexpected changes could affect the bullish sentiment.

Technical Analysis

At first glance, XAU/USD looks like it’s poised to move downward if $2277.34 is taken out by high-volume selling. However, “The Stopper” is defending the market around $2286.83 from a washout. No rally will occur unless buyers can retake the 50-day moving average at $2338.59.

For more detailed insights and updates, you can check the daily gold updates on Daily Gold Signal and their daily gold update section.