The gold price (XAU/USD) has struggled to establish a clear direction while remaining below the $2,330 mark. This indecisiveness is largely due to uncertainties surrounding the Federal Reserve’s potential rate cuts and upcoming US PMI data.

Market Uncertainty

Gold price movements are muted because traders are hesitant to make bold moves amid uncertain signals from the Federal Reserve. Recent US inflation data supports expectations for rate cuts in September and December. Nevertheless, hawkish remarks from key Fed members suggest there’s no immediate plan to lower rates, increasing market uncertainty.

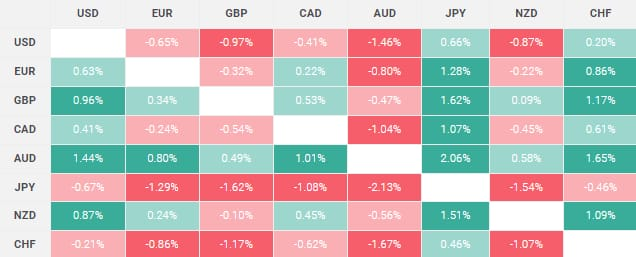

US Dollar Influence

The US Dollar’s recent pullback from a two-month peak provides some support to gold price direction. Geopolitical tensions and uncertainties from France’s elections also enhance gold’s attractiveness as a safe haven. Despite this, concerns over potential inflation from a Trump presidency and higher US Treasury yields limit significant gold price increases.

Key Economic Data

Recent economic data presents varied effects on gold prices. US inflation slowed in May, suggesting possible rate cuts. The US Dollar dropped in response, aiding gold.However, political uncertainties such as France’s election outcomes and US-China trade tensions add to the complexity.

Technical Analysis

Technically, gold remains below the 50-day Simple Moving Average (SMA) near $2,338-$2,340, a pivotal resistance. Inability to surpass this level signals possible bearish trends, though neutral oscillators advise caution. Sustained strength above this resistance could push gold towards $2,360-$2,365 and possibly the all-time peak around $2,450.

US PMI Data Impact

Traders are keenly watching the US ISM Manufacturing PMI data. Along with broader market sentiment, this data will influence gold prices. Any significant deviation from expectations could drive price movements.

Conclusion

In summary, gold prices are currently directionless due to mixed economic signals and geopolitical uncertainties. Traders should monitor key economic data and Federal Reserve comments closely for future price direction. For daily updates on gold prices, check Daily Gold Signal. For a more in-depth analysis, check out the Daily Gold Update category.