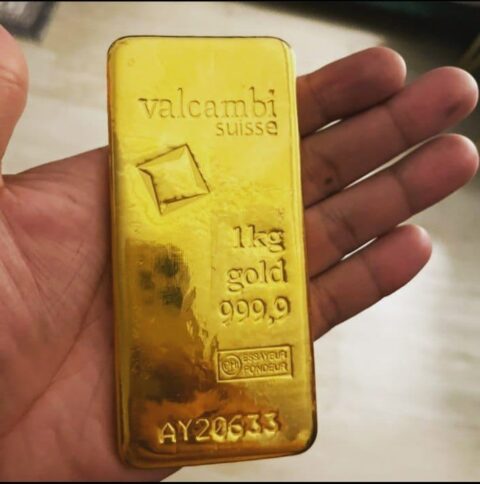

Gold price tumbles as it extends losses for the fourth consecutive day, hovering near $2,400. Rising US Treasury bond yields are a major factor capping gold prices. The US dollar remains strong amid news that President Joe Biden has exited the presidential race, endorsing Vice President Kamala Harris to run against former President Donald Trump in the upcoming elections on November 5. Currently, XAU/USD is trading at $2,397, marking a decline of 0.14%.

Market Reaction to Political Developments

Wall Street opened the week positively, possibly reacting to Biden’s announcement. Meanwhile, the yield on the US 10-year Treasury note increased by two basis points to 4.26%, which is generally negative for gold. An analyst from StoneX noted that Trump’s victory might boost gold due to his policies on tax cuts, less regulation, and an expanded budget deficit. Trump’s approach could lead to higher inflation and geopolitical tensions, which tend to favor gold, while Harris’ foreign policy remains uncertain, potentially supporting gold in the short term but not in the long run.

Technical Analysis

Gold price tumbles have remained defensive but show signs of stabilizing. Monday’s decline was smaller than Friday’s, which saw a loss of more than 1.80%. The Relative Strength Index (RSI) is in bullish territory and has leveled off rather than declining. For gold prices to drop further, sellers need to maintain spot prices below $2,400. If this occurs, the first support level would be the 50-day Simple Moving Average (SMA) at $2,359, followed by the 100-day SMA at $2,315, and further declines towards $2,300.

Conversely, if XAU/USD stays above $2,400 and surpasses $2,450, it could challenge the all-time high of $2,483 before possibly reaching $2,500.

For more insights and updates on gold prices, you can visit Daily Gold Signal for daily gold updates. Stay informed on the latest market trends by exploring our Daily Gold Update category.