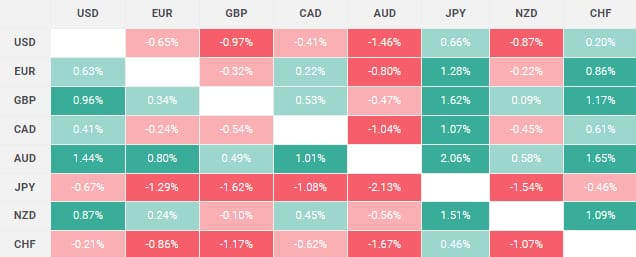

The gold price rebounds (XAU/USD) has seen an upward trend, trading around $2,400 per troy ounce during Monday’s European session. This movement reflects growing expectations of potential Federal Reserve (Fed) rate cuts. Recent US Personal Consumption Expenditures (PCE) Price Index data, released on Friday, highlighted modest inflation increases in June. This has bolstered hopes for an imminent rate-cutting cycle by the Fed. As a result, US Treasury bond yields have declined, which negatively impacts the US Dollar (USD) and supports the gold price.

Impact of Inflation Data and US Dollar Weakness

The modest rise in inflation data has contributed to a decline in US Treasury bond yields. This drop weakens the USD, which benefits the gold price rebounds. Lower yields make non-yielding assets like gold more attractive, supporting its price.

Geopolitical Risks and Market Sentiment

Geopolitical uncertainties, especially from Middle East conflicts, add further support to gold prices. However, global equity markets’ upbeat mood might limit gold’s upside potential. Traders are also awaiting the outcome of the Federal Open Market Committee (FOMC) meeting on Wednesday. Key US macroeconomic data, including the Nonfarm Payrolls (NFP) report, are expected to provide fresh direction for gold.

Market Movers and Economic Indicators

Recent US inflation data has led to expectations of Fed rate cuts, boosting gold prices. The Bureau of Economic Analysis reported a 0.1% increase in the PCE Price Index for June. Yearly inflation eased slightly to 2.5%, matching expectations. The core PCE Price Index, excluding food and energy, showed a steady annual rate of 2.6% and a monthly rise of 0.2%.

Technical Analysis: Gold Price Resistance and Support

Technically, gold price struggles to maintain levels beyond $2,400. Resistance is likely near $2,412, with further hurdles around $2,432. A sustained rise above these levels may lead to further gains, potentially reaching $2,469-$2,470. Conversely, a drop below $2,380 might attract buyers near the 50-day SMA, around $2,360. A breakdown through this support could push gold to $2,325 and possibly $2,300.

In summary, the gold price is benefiting from lower US Treasury yields and geopolitical risks. Despite this, global equity market strength and upcoming economic data may influence future movements. For daily updates on gold prices, you can visit Daily Gold Signal or check out the Daily Gold Update.