The Gold price forecast (XAU/USD) is hovering around the $2,500 psychological support level, facing minor losses. Despite the recent dip, expectations of the US Federal Reserve (Fed) lowering interest rates in September could limit further declines. Lower rates tend to favor gold by reducing the opportunity cost of holding the non-yielding asset.

Factors Supporting Gold Prices

The ongoing geopolitical tensions in the Middle East and rising economic uncertainties are likely to increase the demand for safe-haven assets, benefiting gold. However, China’s economic slowdown, as the world’s largest gold price forecast producer and consumer, might counterbalance this upward pressure.

Upcoming Economic Data and Its Impact

Key economic data releases in the US this week could significantly influence gold prices. The July Durable Goods Orders report is expected later today. Additionally, market participants are eagerly awaiting the preliminary US Gross Domestic Product (GDP) Annualized data for the second quarter and the Personal Consumption Expenditures-Price Index (PCE) for July, both scheduled for Thursday and Friday.

Daily Market Movers Digest

Fed’s Upcoming Decisions

On Friday, Fed Chair Powell expressed the need for policy adjustments during the Kansas City Fed’s annual economic symposium at Jackson Hole. The July Federal Open Market Committee (FOMC) Minutes revealed that a “vast majority” of Fed officials support a September rate cut, provided there are no unexpected data surprises.

Regional Fed Views

Philadelphia Fed President Patrick Harker indicated support for two or three rate cuts in 2024, depending on economic developments. Similarly, Chicago Fed President Austan Goolsbee stated that monetary policy is currently at its tightest, and the Fed is now focusing on meeting its employment objectives.

Geopolitical Tensions

On the geopolitical front, tensions escalated as Hezbollah launched a significant attack on Israel, leading to retaliatory strikes by Israel’s military. This event could further bolster gold’s appeal as a safe-haven asset.

Market Expectations

The CME FedWatch Tool shows that financial markets have fully priced in a 25 basis points (bps) rate cut, with the probability of a deeper cut increasing to 36.5%, up from 24% last week.

Technical Analysis: Gold’s Long-Term Bullish Momentum

Gold remains within a five-month-old ascending trend channel, with the bullish momentum intact as long as it stays above the key 100-day Exponential Moving Average (EMA) on the daily chart. The 14-day Relative Strength Index (RSI) near 62.70 suggests the trend still favors the bulls.

If gold maintains its bullish stance, we could see it rally to the $2,530-$2,535 region, which represents both the record high and the upper boundary of the trend channel. A decisive breakout above this level could drive the price toward the $2,600 psychological barrier.

Support and Resistance Levels

On the downside, the initial support is at $2,470, the low of August 22. If XAU/USD falls below this level, it could trigger a deeper decline toward $2,432, the low of August 15. The critical support zone lies between $2,350 and $2,360, where the lower limit of the trend channel and the 100-day EMA converge.

US Dollar Performance in the Last 7 Days

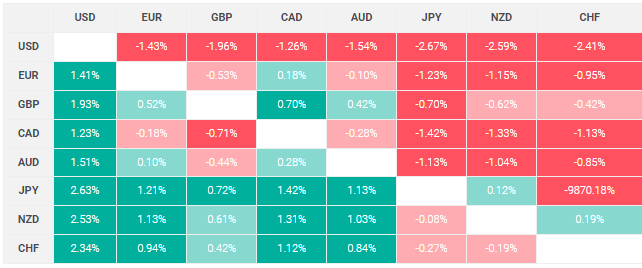

The table below illustrates the percentage changes of the US Dollar (USD) against major currencies over the past week. The USD has shown the most weakness against the Japanese Yen, highlighting potential shifts in currency dynamics.

Heatmap Explanation

The heatmap below displays percentage changes between major currencies. The left column lists the base currencies, while the top row lists the quote currencies. The intersection of each row and column shows the percentage change for the base currency against the quote currency.

Conclusion

As the week progresses, economic data and geopolitical developments will continue to impact gold prices. Investors should monitor these factors closely to gauge potential market movements.

For more detailed updates, visit Daily Gold Signal and check out the daily gold update for in-depth analysis.