Gold prices edges lower (XAU/USD) dipped on Friday as the US Dollar (USD) firmed up. This drop was primarily driven by strong US economic data, including an impressive growth report and lower-than-expected Initial Jobless Claims. The anticipation of a significant rate cut by the Federal Reserve (Fed) in September has decreased, adding pressure on non-yielding assets like gold. However, ongoing geopolitical tensions in the Middle East and the conflict between Russia and Ukraine could enhance the demand for safe-haven assets, which may benefit gold prices in the near term.

Impact of US Economic Data on Gold Prices

The recent US economic reports have led to reduced expectations for a substantial rate cut by the Fed. Investors are now closely watching the upcoming inflation data, particularly the core Personal Consumption Expenditures (PCE) Price Index. The PCE index is forecasted to rise by 2.7% year-over-year in July, slightly up from 2.6% in June. If the PCE data comes in lower than expected, it could prompt the Fed to initiate a rate-cutting cycle, which may support a rebound in XAU/USD.

Market Reactions and Gold Price Movements

This week, Russia’s multiple air strikes on Ukraine have significantly impacted the region. With Ukraine’s concerns over a potential troop buildup near Belarus, the geopolitical risks remain elevated. Such tensions often increase demand for gold, considered a safe-haven asset during times of crisis. Additionally, the US economy showed robust growth, with the Gross Domestic Product (GDP) increasing by 3.0% in the second quarter, exceeding expectations.

The latest US Initial Jobless Claims figures also reflected a healthier job market, declining to 231,000 for the week ending August 24. The lower jobless claims, coupled with a strong GDP, have lessened the likelihood of aggressive rate cuts by the Fed.

Fed Rate Cut Expectations and Market Sentiment

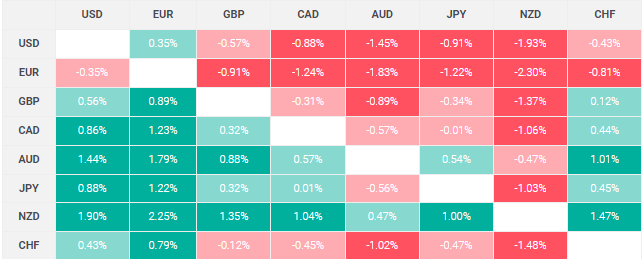

Atlanta Fed President Raphael Bostic recently hinted that rate cuts could be on the horizon, particularly if inflation continues to ease and unemployment rises. However, he emphasized the need for further evidence from upcoming jobs and inflation reports. Currently, market participants are pricing in a 66% chance of a 25 basis points rate cut in September, while the probability of a larger cut stands at 34%.

Technical Outlook: Gold Price Analysis

From a technical perspective, gold prices remain in a bullish trend over the longer term, despite a recent dip. The precious metal is trading above the crucial 100-day Exponential Moving Average (EMA), indicating strong support. Additionally, the 14-day Relative Strength Index (RSI) near 60.75 suggests that bullish momentum could continue.

Key resistance for gold is found near the all-time high of $2,530, which also aligns with the upper boundary of the current trend channel. Should prices push beyond this level, the next significant resistance is at the $2,600 psychological mark. On the downside, initial support lies at the $2,500 mark. A break below this level could open the door to further declines, targeting $2,432, with the 100-day EMA at $2,382 providing additional support.

Conclusion

Gold prices have faced pressure from a strong US Dollar and positive economic data, but ongoing geopolitical tensions and potential shifts in Fed policy could offer support. As the market awaits the US PCE data, investors should stay informed and consider the possible implications on gold prices. For more detailed daily updates on gold, check out the Daily Gold Update section, and for broader market insights, visit Daily Gold Signal.