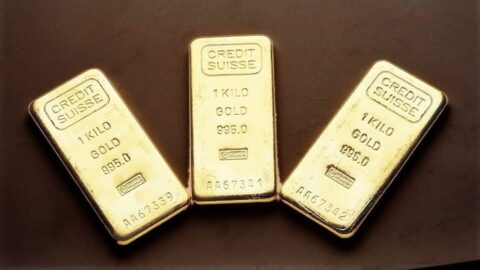

Gold prices saw a rise in late July after a brief dip earlier in the month. By mid-August, gold prices surpassed $2500 per troy ounce and stayed above this level for the rest of the month. This increase in gold prices is largely due to higher demand from central banks.

Central Banks Boosting Gold Demand

Central banks have been driving the demand for gold, especially during times of market uncertainty. For example, in early August, financial markets experienced turmoil, causing stock markets, other commodities, and bond yields to drop. This was due to fears of a recession in the U.S. and changes in the Yen carry trade after the Bank of Japan raised interest rates. In such uncertain times, gold becomes a safe investment option, increasing its demand.

Revised Gold Price Predictions

Given gold’s strong performance, NAB commodity experts have updated their predictions. They now expect gold to average $2315 per ounce in 2024, with a slight decrease to $2290 per ounce in 2025. These new forecasts highlight the ongoing importance of central bank demand in keeping gold prices high.

Conclusion: Future of Gold Prices

Gold prices continue to be strong, supported by central bank purchases and ongoing market uncertainty. For the latest updates and insights on gold prices, check out our daily gold updates.

For more information and regular updates on gold prices, visit our homepage.