Gold price (XAU/USD) experienced a sharp drop of about 3% on Wednesday, following the unexpected victory of Donald Trump in the U.S. presidential election. The metal rebounded on Thursday, climbing back into the $2,670s. The price movement was primarily influenced by Trump’s policies, a stronger U.S. Dollar, and shifting investor preferences. In this article, we’ll analyze why gold dropped sharply and its potential direction moving forward.

Gold’s Decline After Trump’s Election Victory: Impact on Gold Prices and Market Trends

Gold saw a dramatic fall when Trump secured the U.S. presidency by surpassing 270 electoral votes. On Thursday, Trump led with 295 electoral votes, while his opponent, Joe Biden, had 226 votes. The Republican Party also gained control of the Senate and was on track to win a majority in the U.S. Congress.

Gold’s decline was largely due to a stronger U.S. Dollar (USD), which rose as investors anticipated Trump’s economic policies. These included a focus on pro-tariff protectionism and the potential for a more robust dollar. As gold is priced in USD, a stronger dollar directly impacted its value.

Additionally, investors began shifting towards riskier assets, such as stocks and Bitcoin, which were seen as benefiting from Trump’s policies. Bitcoin, in particular, hit a new all-time high, partly due to expectations of relaxed crypto regulations under Trump’s administration. As a result, gold faced outflows as investors rebalanced their portfolios, moving their assets into higher-risk markets.

Geopolitical Tensions and Gold’s Safe-Haven Demand

Gold often rises in value during times of geopolitical instability and conflict. Trump’s promises to resolve international crises, particularly in the Middle East and Ukraine, had the potential to reduce the safe-haven demand for gold. Although Trump’s statements were bold, such as claiming to resolve the Ukraine-Russia conflict within 24 hours, markets reacted to his assurances by reducing demand for gold as a safe-haven asset.

Technical Analysis: Gold’s Short-Term Downtrend

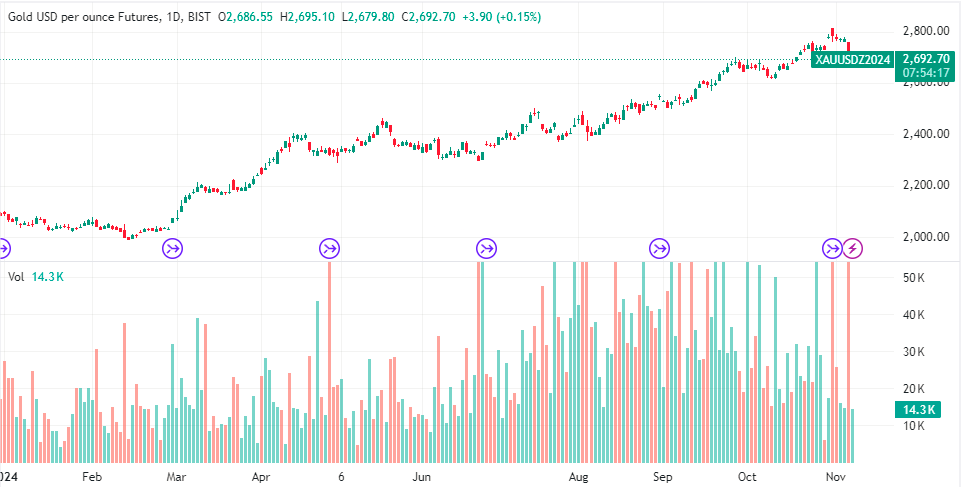

Following the drop below the $2,700 mark, gold settled in the mid $2,650s on Thursday, entering a short-term downtrend. The price action suggested that gold could continue to face weakness in the short term. However, technical indicators showed some signs of reversal potential.

The Relative Strength Index (RSI), a momentum indicator, indicated that gold was oversold, meaning further selling could be limited in the near term. If the RSI moves out of the oversold region, traders are advised to close their short positions and potentially open long positions, anticipating a possible price correction.

A break below the daily low of $2,643 would confirm a continuation of the downtrend, with the next support target at $2,605. However, the longer-term trend for gold remains bullish, and any major downward movement could present a buying opportunity for long-term investors.

Medium-Term Outlook: Gold’s Potential for Reversal

Despite the short-term downtrend, the longer-term outlook for gold remains positive. A break above the previous all-time high of $2,790 would signal a continuation of the upward trend. Gold could then push towards resistance levels at $2,800 and $2,850, continuing its long-term uptrend.

Conclusion

Gold experienced a sharp decline after Donald Trump’s election victory but has found support at around $2,670. The stronger U.S. Dollar, investor preferences for riskier assets, and potential changes in geopolitical dynamics all contributed to this drop. Despite the current short-term downtrend, the overall outlook for gold remains positive, with a chance for a reversal and further price increases in the medium and long term.

For up-to-date gold news and expert analysis, visit our Daily Gold Signal for regular insights and updates. Also, explore our Daily Gold Update for the latest trends and market shifts.