Gold prices have recently faced significant volatility, reflecting the ongoing shifts in global markets. Despite heavy intraday losses, the yellow metal successfully defended the 100-period Simple Moving Average (SMA) on the H4 chart. This article explores the key factors influencing gold’s price, including economic indicators, geopolitical developments, and technical analysis.

Key Market Influences on Gold

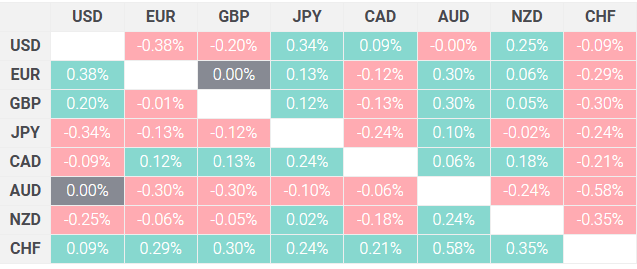

The gold price continues to face pressure from a strengthening US Dollar (USD). Optimism surrounding market developments, including the nomination of Scott Bessent as the US Treasury Secretary, has driven investor confidence. Additionally, reports suggesting a potential ceasefire agreement between Israel and Hezbollah further bolstered risk appetite.

US Economic Indicators and Federal Reserve Outlook

A series of positive US economic data has added to the upbeat market tone. S&P Global’s Composite US PMI reached 55.3 in November, marking its highest point since April 2022. This hints at accelerated economic growth in Q4. Moreover, recent hawkish commentary from Federal Reserve officials supports the possibility of interest rates remaining steady in December.

The CME Group’s FedWatch Tool shows a 55% probability of a 25 basis point rate cut next month. These factors continue to strengthen the USD, which traditionally weighs on gold prices.

Technical Analysis: Gold Price Defends 100-Period SMA on H4 Chart

Support Levels to Watch

Gold’s intraday decline stalled near the $2,658-$2,650 range, supported by the 100-period SMA. Further downside might be seen if this pivotal level is broken. The 38.2% Fibonacci retracement at $2,650 and subsequent levels like $2,630 and $2,608 are critical areas to monitor.

Resistance Levels to Break

On the upside, the $2,677-$2,678 zone, corresponding to the 23.6% Fibonacci retracement, serves as immediate resistance. A break above $2,700 could trigger a stronger recovery, targeting the $2,750 zone and potentially the all-time high near $2,790.

Gold prices remain under pressure due to a strong USD and improving market sentiment. While technical indicators suggest potential for both support and resistance testing, the precious metal’s trajectory depends on upcoming economic data and geopolitical developments. For in-depth daily updates on gold price trends and market insights, visit Daily Gold Signal. Additionally, explore the Daily Gold Update for comprehensive analysis.