Gold price experienced a pullback on Thursday, ending a four-day streak of gains with a decline of over 1%. Mixed economic signals from the United States influenced the market, causing uncertainty among investors. While the jobs report reflected a softer-than-expected outlook, producer prices remained elevated. This dynamic limited upward momentum for gold, with XAU/USD trading at $2,684.

Mixed US Economic Data and Market Reactions

The Producer Price Index (PPI) for November surpassed expectations, suggesting the disinflation process might be slowing. At the same time, the US labor market showed signs of cooling, with unemployment claims exceeding forecasts. These factors contributed to the recent fluctuation in gold price as traders weighed potential Federal Reserve actions.

Federal Reserve’s Rate Cut Speculation

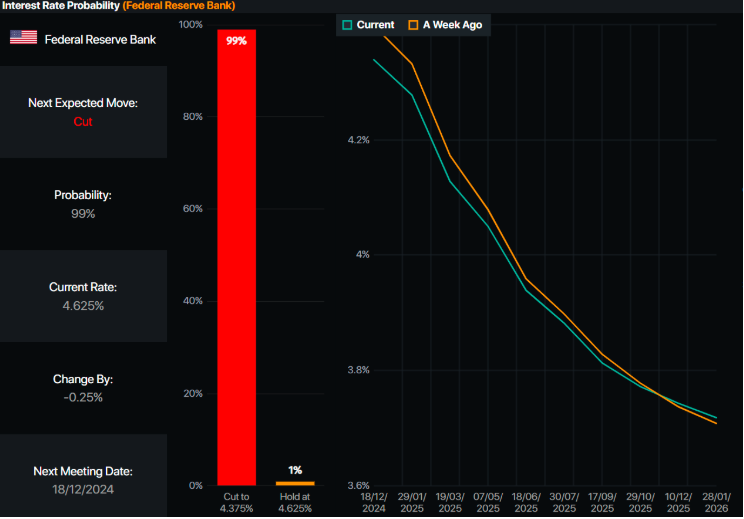

Ahead of the Federal Reserve’s policy decision next week, traders appear to be booking profits. According to the swaps market, there is a 98% likelihood that the federal funds rate will adjust to the 4.25%-4.50% range.

Global Influences on Gold Market Trends

European Central Bank Policies

Earlier this week, the European Central Bank (ECB) reduced interest rates for the third consecutive meeting. This move signaled potential further easing as inflation trends toward the ECB’s 2% target. These developments could indirectly influence gold prices as global monetary policies shift.

Treasury Yields and Gold Movement

A minor uptick in the US 10-year Treasury bond yield, increasing by 1.5 basis points to 4.289%, contributed to gold’s recent downturn. Higher yields often make non-yielding assets like gold less attractive.

Current Market Metrics and Trends

Daily Digest of Market Movers

- US Real Yields: Gold prices responded to a rise in US real yields, which increased by two basis points to 1.996%.

- US Dollar Strength: The US Dollar Index remained firm at 106.75, reflecting a 13% annual gain.

- PPI Data: November’s PPI report highlighted a 3% YoY increase in headline inflation and a 3.4% rise in core PPI, both exceeding expectations.

- Labor Market: Initial jobless claims for the week ending December 7 rose to 242K, surpassing estimates of 220K.

These metrics, combined with earlier CPI data, reinforced the case for another Federal Reserve rate cut. However, market speculation indicates further easing by the end of 2024, with analysts predicting significant policy adjustments by 2025.

Technical Analysis and Forecast

Gold’s Price Outlook

Gold’s bullish momentum remains intact despite a pullback to the 50-day Simple Moving Average (SMA) near $2,670. If sellers gain control, the price may decline to $2,650, with further support at $2,600. Alternatively, a breakout above $2,700 could lead to testing the $2,721 resistance and eventually targeting the record high of $2,790.

Conclusion and Further Reading

Gold prices are navigating a complex landscape shaped by mixed economic data and rate cut speculations. While short-term trends show a pause in the rally, underlying bullish momentum persists. As global central banks adapt their policies, gold’s role as a hedge remains pivotal.

For more insights, explore our daily updates on gold prices. To stay informed about the latest trends, visit Daily Gold Signal.