The gold price (XAU/USD) retraced a significant portion of its intraday gains during Friday’s European session. This decline pushed the precious metal towards the lower end of its daily range. The consistent strength of the US Dollar (USD), driven by elevated US Treasury bond yields, has created headwinds for gold. These yields reflect market expectations that the Federal Reserve (Fed) will maintain a cautious approach to cutting interest rates. Recent inflation data suggests that progress towards the Fed’s 2% target has stalled, further supporting the USD.

However, the downside potential for gold seems restricted as investors await the upcoming Federal Open Market Committee (FOMC) policy meeting. Heightened geopolitical tensions, including the ongoing Russia-Ukraine conflict and escalating instability in the Middle East, reinforce gold’s appeal as a safe-haven asset. These factors suggest traders might adopt a wait-and-see approach before placing aggressive bets.

Key Market Factors Influencing Gold Price

Geopolitical Tensions Bolster Gold’s Safe-Haven Demand

The geopolitical landscape remains turbulent. Ukraine’s use of US-supplied missiles to target Russian sites and Russian advances near Pokrovsk mark a significant escalation. Similarly, Israel’s decision to maintain control over Syrian territories until new security conditions are met adds to global instability. These developments have driven haven flows into gold, reflecting investors’ cautious sentiment.

Federal Reserve’s Rate Outlook Under Scrutiny

The Fed’s approach to interest rates is a pivotal factor for the gold market. While November’s Producer Price Index (PPI) data exceeded expectations, signaling persistently high inflation, the Fed is expected to proceed cautiously. Markets are pricing in a 25 basis point rate cut during the December FOMC meeting. This expectation has bolstered US Treasury yields and supported the USD, thereby limiting gold’s upward momentum.

Technical Analysis of Gold Price Trends

From a technical perspective, gold faces immediate resistance near $2,725, just below the recent monthly high. A break above this level could propel prices towards $2,750, with the next key barrier at $2,775. On the downside, immediate support lies in the $2,675-$2,674 range. A decisive break below this could lead to further declines towards $2,658, where key moving averages converge. Should this level fail, gold may weaken further towards $2,630.

US Dollar Performance This Week

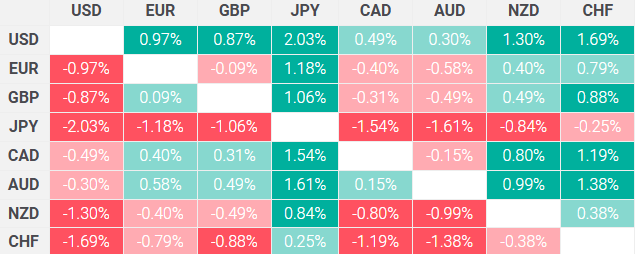

The US Dollar has maintained its dominance against major currencies, notably outperforming the Japanese Yen. The following table highlights the percentage changes in the USD against other major currencies this week:

| Base/Quote Currency | Percentage Change |

|---|---|

| USD/JPY | +X.XX% |

This trend underscores the USD’s strength, which continues to pressure gold prices.

Conclusion

While gold prices have surrendered part of their recent gains, the downside appears limited due to upcoming Fed decisions and geopolitical uncertainties. For those tracking gold market trends, visit Daily Gold Signal for updates. To explore gold price movements further, check out Daily Gold Update.