Gold price analysis maintains stability as it trades above the $2,600 mark, bolstered by a cautious market sentiment. Geopolitical tensions, trade concerns, and the looming threat of a U.S. government shutdown drive investors toward safe-haven assets like gold. Additionally, declining U.S. Treasury bond yields and a softer U.S. Dollar (USD) provide further support for the yellow metal.

Risk-Off Mood Boosts Gold Demand

Persistent global uncertainties, including fears of escalating geopolitical risks, have increased demand for gold. The possibility of a U.S. government shutdown adds to market unease, prompting investors to seek the stability of bullion. Lower bond yields have tempered the USD’s recent rally, creating a favorable environment for gold prices.

Fed’s Stance Limits Gold’s Gains

The Federal Reserve’s hawkish signal to slow the pace of rate cuts in 2025 has kept U.S. bond yields elevated, favoring USD strength. This scenario has limited the upside potential of non-yielding gold despite its current price stability above $2,600. Investors are exercising caution while waiting for the U.S. Personal Consumption Expenditure (PCE) Price Index, a critical measure influencing inflation expectations and USD dynamics.

Key Economic Data Highlights

The U.S. economy expanded by 3.1% on an annualized basis during the third quarter, surpassing the earlier estimate of 2.8%. These factors reinforce the Fed’s outlook for gradual rate adjustments, which could influence gold’s trajectory.

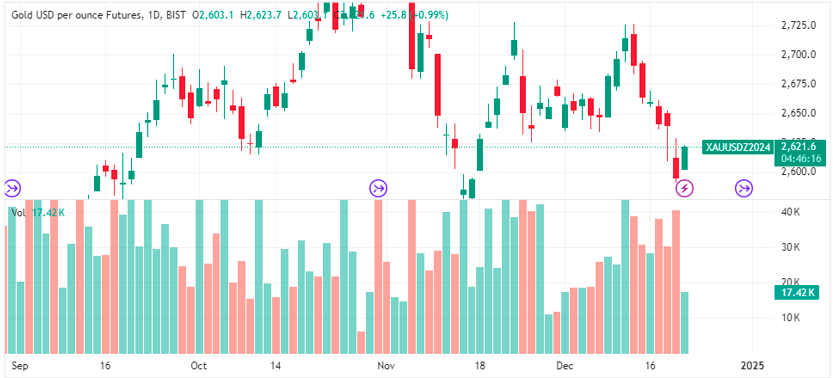

Gold Price Technical Analysis

Immediate Resistance Levels

Gold’s recent decline below the 100-day Simple Moving Average (SMA) indicates bearish momentum. However, oscillators on the daily chart suggest potential for recovery. The $2,626 level, representing the overnight swing high, is a key resistance point. Breaking above this level could trigger a rally toward the $2,652-$2,655 range.

Key Support Zones

On the downside, the monthly low of $2,583 acts as a strong support level. A sustained dip below this mark could lead to further declines, targeting $2,560 and $2,537 zones, with the 200-day SMA at $2,472 providing critical long-term support.

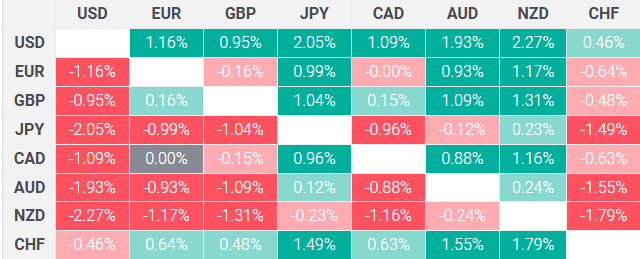

US Dollar’s Weekly Performance

The U.S. Dollar has displayed a varied performance against major currencies. It gained the most against the New Zealand Dollar this week. The table below highlights the weekly percentage changes of the USD against other currencies:

| Base/Quote Currency | Weekly % Change |

|---|---|

| USD/NZD | +1.8% |

| USD/JPY | +0.5% |

| USD/EUR | -0.3% |

For further insights on gold price trends, visit Daily Gold Signal and explore our Daily Gold Updates.