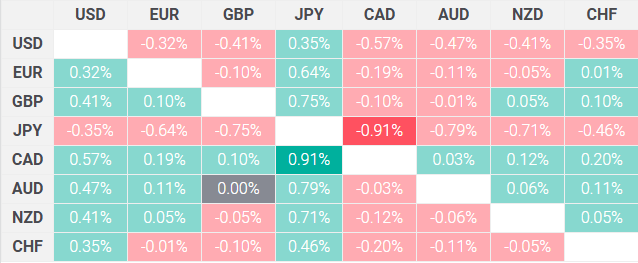

Gold price (XAU/USD) has dropped for the second day in a row, after briefly touching the $2,647-$2,648 range on Monday. This decline follows a three-week high achieved last Friday. The Federal Reserve’s (Fed) plans to maintain elevated interest rates through 2025 continue to support US Treasury yields, which negatively impacts non-yielding assets like Gold. Additionally, a generally positive market outlook adds pressure on the safe-haven metal.

Factors Influencing Gold Price Trends

The US Dollar (USD) has weakened slightly after hitting its highest level since November 2022 last week. This offers limited support to Gold prices. Geopolitical tensions and trade war concerns, however, help cushion the declines. Traders are cautious ahead of significant US economic reports this week, such as the Nonfarm Payrolls (NFP) on Friday and the Federal Open Market Committee (FOMC) meeting minutes on Wednesday. These updates are expected to influence USD performance and Gold’s near-term movement.

Fed’s Policy and Its Impact on Gold

The Institute of Supply Management’s (ISM) recent report revealed an improvement in US Manufacturing PMI, rising to 49.3 in December. This signals economic resilience and aligns with the Fed’s slower pace of rate cuts in 2025. Elevated US Treasury yields, including the 10-year yield hitting its highest level since May, have strengthened the USD. This has further reduced Gold’s appeal among investors.

San Francisco Fed President Mary Daly highlighted that inflation remains above the Fed’s 2% target despite recent progress. This supports the Fed’s hawkish stance, weighing down on Gold’s demand.

Geopolitical Events and Market Sentiment

Geopolitical risks continue to influence investor sentiment. Israeli forces have attacked medical facilities in Gaza, with additional raids reported in the West Bank. Meanwhile, Ukraine launched surprise counterattacks in Kursk against Russian forces, escalating tensions. These developments contribute to global uncertainty, offering slight support to Gold as a safe-haven asset.

Technical Analysis of Gold Price

From a technical perspective, Gold’s next support level lies near the 100-day Simple Moving Average (SMA) at $2,625. A break below this could push prices towards $2,600 or even the December low near $2,583. On the other hand, if Gold breaks above $2,647, it could test resistance at $2,665, with a potential rise toward $2,700. This pivotal point, if cleared, could extend the two-week-long uptrend.

Conclusion: Key Takeaways for Gold Price

The Gold market is currently impacted by the Fed’s hawkish outlook, modest USD weakness, and geopolitical risks. Key US economic data and the FOMC minutes this week will be crucial in shaping near-term price movements. Stay informed with daily insights or explore more at Daily Gold Signal.