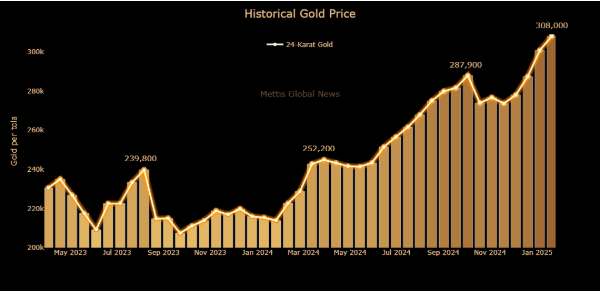

Gold prices in Pakistan soared to a historic peak on Wednesday, with 24-karat gold reaching Rs308,000 per tola. This marked a significant increase of Rs3,800 in a single day, reflecting the impact of both local and global economic factors. For investors and traders, this surge is a critical development that demands attention.

Key Highlights:

- 24-karat gold per tola: Rs308,000 (+Rs3,800).

- 24-karat gold per 10-gram: Rs264,060 (+Rs3,258).

- 22-karat gold per 10-gram: Rs242,063.

- Silver prices: Rs3,440 per tola (+Rs90) and Rs2,949 per 10-gram (+Rs77).

For the latest updates on gold prices, visit Daily Gold Signal.

Why Are Gold Prices Rising?

Global Economic Uncertainty

The primary driver behind the surge in gold price is global economic uncertainty. Internationally, spot gold traded near $2,945 an ounce, up 0.39% from the previous session. This increase is largely due to concerns about economic growth and geopolitical tensions, particularly surrounding U.S. trade policies.

Local Market Dynamics

In Pakistan, the rise in gold price is also influenced by local factors such as currency fluctuations and increased demand. The All-Pakistan Gems and Jewelers Sarafa Association (APGJSA) reported significant gains in both gold and silver prices. Below is a summary of the recent price movements:

| Commodity | Feb 19, 2025 | Feb 18, 2025 | Daily Change | 1-Month Change | FYTD Change | CYTD Change |

|---|---|---|---|---|---|---|

| Gold (24-karat) | Rs308,000 | Rs304,200 | +Rs3,800 | +Rs25,100 | +Rs66,300 | +Rs35,400 |

| Silver (24-karat) | Rs3,440 | Rs3,350 | +Rs90 | +Rs68 | +Rs590 | +Rs90 |

Expert Insights

Economic uncertainty, particularly around U.S. President Donald Trump’s tariff plans, has driven investors toward safe-haven assets like gold. This trend is expected to continue as global markets remain volatile.

What Does This Mean for Investors?

Gold as a Safe-Haven Asset

Gold is widely regarded as a safeguard against inflation and economic uncertainty. Its recent surge highlights the following key points:

- Safe-Haven Demand: Investors flock to gold during times of uncertainty.

- Currency Fluctuations: The Pakistani rupee’s performance impacts local gold prices.

- Global Trends: International gold prices directly influence domestic markets.

Investment Opportunities

The record-high gold prices present both opportunities and challenges for investors. While gold can be a good way to safeguard wealth during uncertain times, its volatility requires careful consideration.

For more detailed updates on gold trends, check out Daily Gold Update.

Conclusion

The record-breaking rise in gold prices underscores the metal’s role as a safe-haven asset during uncertain times. With global economic concerns and geopolitical tensions driving demand, gold prices are likely to remain volatile. Staying informed about market trends can help you make smarter investment decisions.