Gold price (XAU/USD) has reached a fresh all-time high during early European trading on Thursday, confirming a decisive breakout from a short-term trading range. The renewed concerns over trade tensions, driven by US President Donald Trump’s latest tariff threats on imported goods, have significantly boosted investor demand for safe-haven assets like gold. This increased risk aversion has triggered a decline in US Treasury bond yields, exerting downward pressure on the US Dollar (USD) and further supporting the yellow metal.

Key Takeaways:

- Gold price achieves a new record high amid escalating trade tensions.

- Declining US Treasury yields and a weaker US Dollar provide additional support.

- Hawkish FOMC meeting minutes hint at an extended pause on interest rates.

- Market conditions remain favorable for further gold appreciation.

Global Trade Tensions Boost Gold Price

Market sentiment has been rattled following US President Donald Trump’s announcement of upcoming heavy tariffs on various imports. This move has heightened concerns over a further escalation in trade disputes, reinforcing the appeal of gold as a safe-haven asset. Additionally, US Commerce Secretary Howard Lutnick stated in a Fox News interview that Trump aims to eliminate the Internal Revenue Service and shift the tax burden to external entities. Trump also hinted at the possibility of a new trade agreement with China.

The US Dollar has struggled to capitalize on its modest recovery over the past two days due to another leg down in Treasury bond yields. This has provided additional bullish momentum for gold. The recently released minutes from the Federal Open Market Committee (FOMC) policy meeting reaffirmed expectations that the Federal Reserve (Fed) will maintain its current interest rate stance.

Market Analysis and Federal Reserve Insights

FOMC meeting minutes highlighted concerns over economic uncertainty, signaling that the Fed will continue its cautious approach in considering further rate adjustments. Fed Vice Chairman Philip Jefferson emphasized that while economic conditions remain robust, inflation remains elevated, making the path to a 2% inflation target uncertain. Meanwhile, Chicago Fed President Austan Goolsbee noted that inflation remains stubbornly high, suggesting that interest rates will stay elevated for an extended period.

On Thursday, key economic data releases include the Weekly Initial Jobless Claims report and the Philly Fed Manufacturing Index, along with speeches from influential FOMC members. These events could influence USD movement and, in turn, impact gold prices. Investors will also shift their focus to Friday’s global Purchasing Managers’ Index (PMI) reports, which will provide further insights into global economic conditions and potentially drive safe-haven demand for gold.

Technical Analysis: Gold Bulls Maintain Control

From a technical standpoint, the daily Relative Strength Index (RSI) remains above the 70 mark, signaling slightly overbought conditions that warrant caution for bullish traders. Despite this, gold prices continue to maintain a strong upward bias. A sustained breakout above the $2,945-$2,950 resistance zone would confirm further upside momentum, paving the way for an extended rally.

Conversely, any short-term pullback could find support near $2,928, followed by $2,918 and the $2,900 psychological level. If selling pressure intensifies, gold could decline toward the $2,880 support zone, with further downside potential near $2,860-$2,855 and $2,834. A break below these levels might trigger additional losses toward $2,815 and $2,800 before stabilizing near $2,785-$2,784.

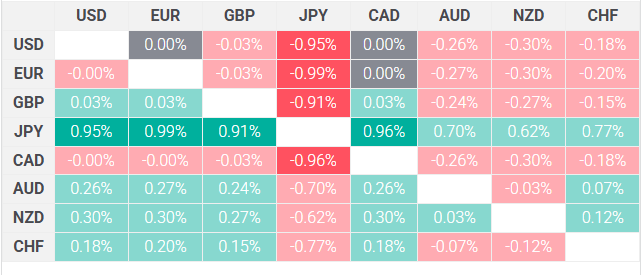

US Dollar Performance Today

The table below illustrates the percentage change of the US Dollar (USD) against major global currencies. Notably, the USD has exhibited the strongest performance against the Canadian Dollar.

For further updates and insights, visit Daily Gold Signal. For more in-depth market analysis, visit Daily Gold Update.