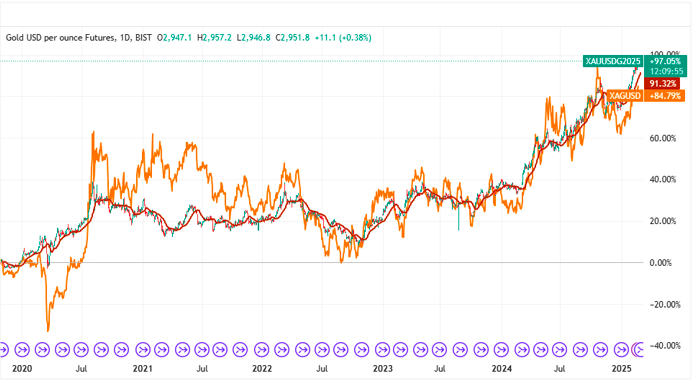

Gold prices (XAU/USD) continue to soar, hovering near another all-time high after reaching record levels earlier in the week. At the time of writing, the precious metal is trading around $2,955, driven by geopolitical tensions and speculation around US-China trade relations.

The latest surge follows US President Donald Trump’s comments suggesting a potential trade deal with China. Simultaneously, geopolitical concerns escalated after Trump claimed Ukraine initiated the conflict with Russia, hinting at the need for repayment for US aid.

Meanwhile, the Federal Reserve’s January meeting minutes, released on Wednesday, had minimal impact on the market. Only a few FOMC members supported maintaining steady interest rates, keeping the possibility of a June rate cut alive.

Key Market Movers: Pressure Builds

- Gold Bar Relocation: Thousands of gold bars are being moved from the Bank of England’s vaults to the US futures market. This shift, driven by arbitrage opportunities, highlights logistical challenges in the global market. Traders are capitalizing on speculation that Trump may impose tariffs on gold, buying spot gold in London and selling futures in the US.

- Gold Fields Ltd. Profit Surge: The mining company reported a 77% increase in annual profit, fueled by rising gold prices and improved operations in Chile and South Africa.

- US-Ukraine Tensions: Relations between the US and Ukraine hit a new low after a social media exchange between Trump and Ukrainian President Volodymyr Zelenskiy. Concerns are growing that Trump may withdraw US support for Ukraine amid the ongoing conflict with Russia.

Technical Analysis: What Could Bring Gold Down?

Despite a softer tone on tariffs and potential US-China trade deals, gold prices are likely to continue their upward trajectory. The path to $3,000 appears clear, with the precious metal expected to reach this milestone soon.

Key Levels to Watch:

- Support Levels:

- $2,947 (Pivot Point R1 resistance, Wednesday’s high)

- $2,933 (Daily Pivot Point)

- $2,919 (Wednesday’s low and S1 support)

- Resistance Levels:

- $2,961 (R2 resistance, likely to be tested)

- $3,000 (Psychological barrier, potential target)

With a light economic calendar, gold prices may test the 2,961 resistance level later in the day. However, the 2,961 resistance level later in the day. However, the 3,000 mark might remain out of reach this week.

Conclusion

Gold’s rally to record highs reflects a combination of geopolitical tensions, trade deal speculation, and market dynamics. While the path to $3,000 seems inevitable, traders should remain cautious as the frenzy reaches its peak.

For more insights and daily updates on gold prices, visit Daily Gold Signal. Explore the latest gold market trends and updates at Daily Gold Update.