Gold prices (XAU/USD) remain near their all-time high, despite a small dip during the early European session on Friday. Investors are worried about US trade policies, which continue to boost demand for Gold as a safe-haven asset.

Key Takeaways

- Gold Near Record High: Despite small losses, Gold remains close to its highest level ever.

- Trade War Concerns: US tariffs on steel, aluminum, and Chinese imports raise economic fears.

- Weaker US Dollar: A declining US Dollar adds support to Gold prices.

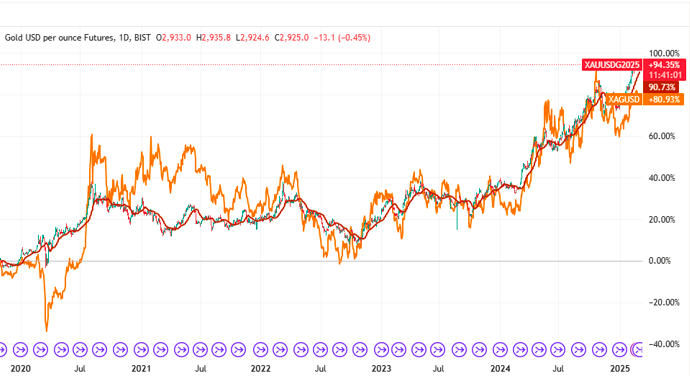

- Technical Analysis: Gold price may see a pullback but remains in an uptrend.

Why Is Gold Still Strong?

Gold is benefiting from concerns over a possible global trade war. US President Donald Trump has imposed heavy tariffs on steel and aluminum and plans to add more tariffs soon. Investors fear these policies will hurt the global economy, making Gold an attractive investment.

Another reason for Gold’s strength is inflation. Many experts believe that protectionist trade policies will push inflation higher. Since Gold is seen as a hedge against inflation, demand for it remains high.

Will Gold Continue to Rise?

From a technical perspective, Gold is still in an uptrend. The price recently broke through the $2,928-$2,930 range, which suggests that buyers remain in control. However, traders should be cautious because Gold is near overbought levels.

Support and Resistance Levels to Watch

- Key Support: $2,900 – If Gold falls, this level could provide strong support.

- Further Support: $2,880 – A drop below $2,900 could lead to this level.

- Key Resistance: $2,950 – A move above this could push Gold even higher.

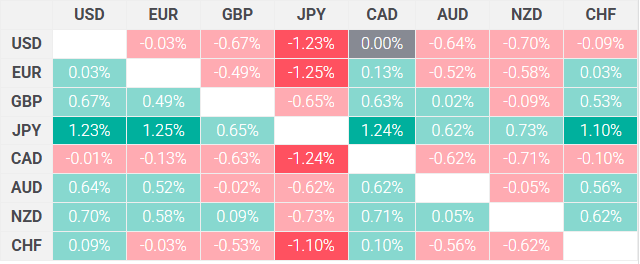

How the US Dollar Affects Gold

Gold and the US Dollar often move in opposite directions. Lately, the US Dollar has weakened, making Gold more attractive. Investors expect the Federal Reserve to cut interest rates, which puts pressure on the Dollar.

However, the Fed remains uncertain about its next move. Some officials warn about inflation risks, while others believe rate cuts are still possible this year. This uncertainty adds to market volatility, helping Gold maintain its strength.

Expert Opinion

“Gold is still one of the best safe-haven assets during uncertain times. With trade war fears and inflation concerns growing, we expect Gold to remain strong,” says market analyst David Crowe.

Conclusion: Gold Remains Bullish Despite Minor Pullbacks

Gold continues to hold near its record high, supported by trade war fears, inflation concerns, and a weaker US Dollar. Traders should watch the $2,900 level for potential buying opportunities. A breakout above $2,950 could push Gold even higher.

For the latest updates on Gold prices and market trends, check out Daily Gold Signal.