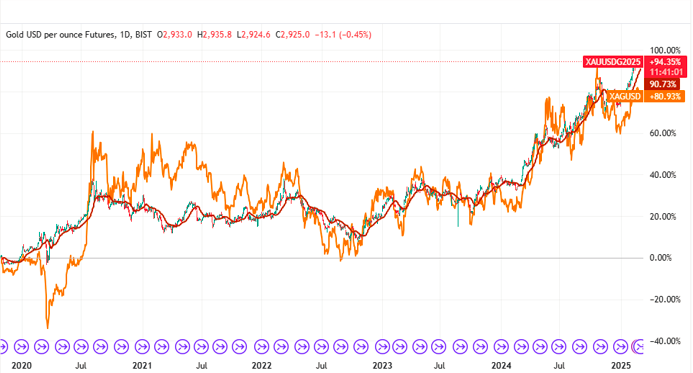

Gold prices drop over 1% from Thursday’s record high of 2,954, trading around 2,954, trading around 2,925 on Friday. This decline comes ahead of the US preliminary Purchase Managers Index (PMI) data for February and amid discussions of potential sanctions relief for Russia. Meanwhile, weak services sector data in Europe and upcoming German elections add to the market’s uncertainty.

Key Points: Gold Prices Drop and Market Movers

- Gold prices dropped over 1% from Thursday’s all-time high of $2,954.

- US preliminary PMI data and potential sanctions relief for Russia influenced the market.

- European services sector activity declined, with France’s PMI falling to 44.5.

- German elections this weekend could impact broader geopolitical dynamics.

Market Context: Gold Prices Drop and Economic Factors

US PMI Data and Geopolitical Developments

The gold prices drop reflects market reactions to key economic indicators, with the US PMI Data for February being a primary focus for traders. The services sector, expected to rise to 53.0 from 52.9 in January, could influence Gold’s trajectory. Additionally, the Trump administration’s comments on lifting sanctions against Russia have added volatility to the market.

European Services Sector Weakness and US PMI Data

Recent data from S&P Global and Hamburg Commercial Bank (HCOB) revealed a contraction in the services sector across France, Germany, and the Eurozone. France’s preliminary Services PMI fell to 44.5, missing estimates and signaling economic challenges.

German Elections Impact and Geopolitical Developments

Germany’s general election this weekend could reshape Europe’s political landscape. The far-right party Alternative for Germany (AfD), backed by figures like Elon Musk, may secure a significant victory, potentially influencing US-EU relations.

Technical Insights

Support and Resistance Levels

- Support Levels:

- S1: $2,923

- S2: $2,908

- Resistance Levels:

- Pivot Point: $2,939

- R1: $2,954 (all-time high)

- R2: $2,969

Market Outlook

Gold’s price movement on Monday will depend on the German election outcome and broader market sentiment. A recovery above the pivot point at 2,939 could signal renew edbullish momentum, while a break below S2 at 2,939 could signal renewed bullish momentum, while abreak below S2 at2,908 may indicate further declines.

Expert Opinions

Geopolitical Impact on Gold

“The potential lifting of sanctions against Russia and the German election results could significantly impact Gold prices,” says a market analyst at Daily Gold Signal.

Chinese Gold Market Trends

Shares of Laopu Gold Co. Ltd surged 21% after reporting a tripling of net profits, defying the luxury spending slowdown. This highlights the resilience of the Gold market in Asia.

Conclusion

Gold’s recent drop reflects a combination of economic data and geopolitical developments. With US PMI data, German elections, and potential sanctions relief for Russia in focus, traders should monitor key support and resistance levels for future price movements.

For more updates on Gold prices and market trends, visit Daily Gold Signal.