Gold price (XAU/USD) is trading higher near $2,945 on Monday, fueled by a weaker US Dollar (USD) following the German federal election results. The Euro (EUR) gained strength as the Christian Democratic Union (CDU) secured a lead, while the far-right Alternative for Germany (AfD) gained significant traction. This political shift has impacted currency markets, creating opportunities for gold traders.

Key Points for Gold Price:

- Gold prices edge higher as the US Dollar weakens post-German election.

- The Euro strengthens, with the CDU leading but AfD gaining 20% of votes.

- US GDP data and Federal Reserve rate cut expectations remain in focus.

- Technical analysis highlights key resistance and support levels for gold.

Market Context: German Election Impact on Gold Price and US Dollar Weakness

The German federal election results have sent ripples through global markets. The CDU’s lead, coupled with the AfD’s surprising 20% vote share, has strengthened the Euro. A stronger Euro often translates to a weaker US Dollar, which benefits gold prices.

Meanwhile, traders are closely watching the upcoming US Gross Domestic Product (GDP) data for Q4 2024. Recent economic slowdowns, including a softer Services PMI reading, have raised expectations of Federal Reserve rate cuts. Such monetary policy adjustments could further weaken the US Dollar, providing additional support for gold price.

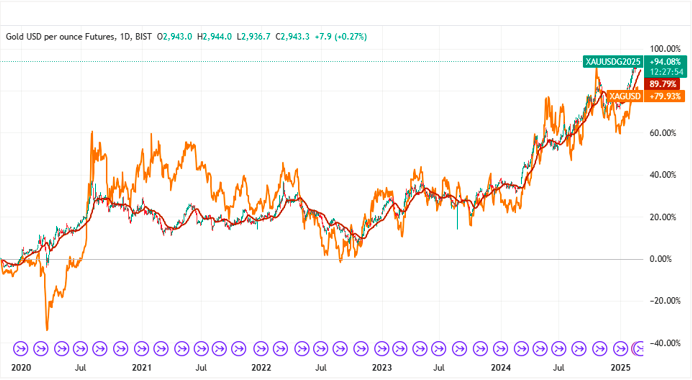

Technical Insights: Gold Price Resistance and Support Levels

Gold’s price action has been volatile, with traders navigating key levels:

Resistance Levels:

- Daily R1 Resistance: $2,951

- All-Time High: $2,955

- R2 Resistance: $2,967

Support Levels:

- Daily Pivot Point: $2,934

- S1 Support: $2,918 (near Friday’s low)

- S2 Support: $2,901

While some analysts predict gold could reach $3,000, recent market behavior suggests caution. Similar predictions for EUR/USD parity earlier this year did not materialize, highlighting the unpredictability of currency and commodity markets.

Expert Opinions and Market Movers

- Equinox Gold’s Acquisition: Canada’s Equinox Gold Corporation is set to acquire Calibre Mining in a $5.4 billion deal, reflecting the mining sector’s confidence in record gold prices.

- US Dollar Weakness: Recent data shows slowing US business activity and declining consumer confidence, with markets pricing in potential Federal Reserve rate cuts.

- German Election Outcome: CDU leader Friedrich Merz faces pressure to form a stable government, while the AfD’s gains signal shifting political dynamics in Europe.

Conclusion: What’s Next for Gold?

Gold’s recent surge highlights its role as a safe-haven asset amid currency fluctuations and political uncertainty. With the US Dollar under pressure and Federal Reserve rate cuts on the horizon, gold prices may continue to find support. However, traders should remain cautious, as technical levels and market sentiment can shift rapidly.

For daily updates on gold prices and market trends, visit Daily Gold Signal. Explore more insights on gold market trends at Daily Gold Update.