The gold price (XAU/USD) fell to $2,929 during Tuesday’s European session. This drop comes after gold hit an all-time high the previous day. The decline is mainly due to profit-taking, as traders sell to lock in gains. However, concerns about global trade tensions and expectations of Federal Reserve rate cuts continue to support gold prices.

Key Points

- Gold price drops to $2,929 as traders take profits.

- Trade war fears and Fed rate cut expectations limit further losses.

- Key support levels to watch: 2,920 and 2,920 and 2,915.

- Upcoming US economic data could influence gold’s short-term direction.

Why Is Gold Falling?

Gold prices are falling because traders are selling to secure profits after a recent rally. This is called profit-taking. Despite the drop, gold remains supported by two main factors:

- Trade War Fears: US President Donald Trump recently confirmed tariffs on Canadian and Mexican imports. This has raised concerns about escalating trade tensions, which could hurt the global economy. Gold often benefits from such uncertainties as it is seen as a safe-haven asset.

- Fed Rate Cut Expectations: Weak US economic data has increased bets that the Federal Reserve will cut interest rates twice this year. Lower interest rates make gold more attractive because it doesn’t earn interest like bonds or savings accounts.

What’s Next for Gold Prices?

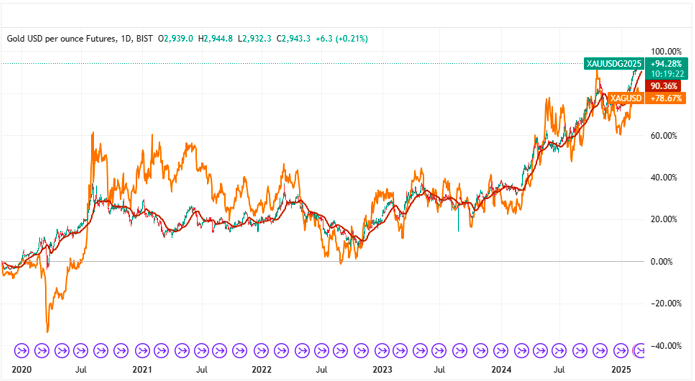

Gold’s recent price movement suggests it is in a consolidation phase. This means prices are stabilizing after a strong rally. While the daily Relative Strength Index (RSI) shows gold is overbought, the overall trend remains bullish.

Key Levels to Watch

- Support Levels: 2,920−2,915, 2,920−2,915, 2,900, $2,880

- Resistance Levels: Record high near $2,950

If gold falls below 2,880, it could drop further to 2,880, it could drop further to 2,860-2,855 and even 2,800. However, buyers are likely to step in around 2,800. However, buyers are likely to step in around 2,920-2,915, preventing a steep decline.

Expert Insights

According to the World Gold Council (WGC), gold ETFs saw their largest weekly inflow since March 2022. This shows strong investor interest in gold as a safe-haven asset.

Chicago Fed President Austan Goolsbee recently stated that the Fed needs more clarity before cutting rates. This cautious approach supports gold prices, as lower rates reduce the opportunity cost of holding gold.

What to Watch This Week

Traders are focusing on upcoming US economic data, including:

- Consumer Confidence Index

- Richmond Manufacturing Index

The most important data will be the US Personal Consumption Expenditure (PCE) Price Index, released on Friday. This report could provide clues about the Fed’s next steps on interest rates.

Conclusion: Gold’s Bullish Trend Remains

While gold prices are falling due to profit-taking, the overall trend remains positive. Trade war fears and Fed rate cut expectations continue to support gold. Traders should watch key support levels and upcoming economic data for short-term opportunities.

For the latest updates on gold prices and market analysis, visit Daily Gold Signal. Explore more insights on gold market trends at Daily Gold Update.