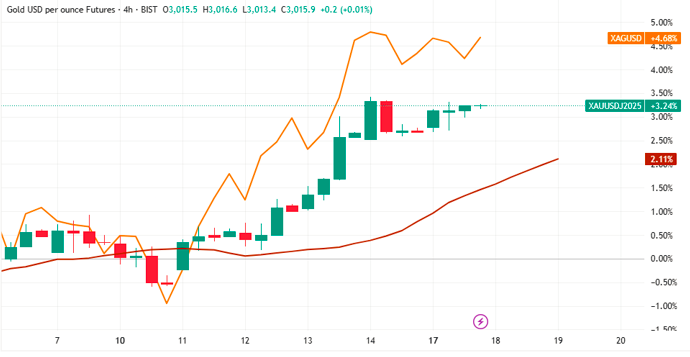

Gold price (XAU/USD) extends its rally, reaching a fresh record high around $3,010 during the Asian session on Tuesday. This marks the metal’s fifth positive day in the last six trading sessions, fueled by a combination of economic uncertainties and global geopolitical tensions.

Key Points for Gold Price:

- Gold price surpasses $3,000, hitting a new all-time high.

- Safe-haven demand increases amid US recession fears and Middle East tensions.

- Market awaits the US Federal Reserve’s policy meeting for further direction.

Gold Market Context: Economic and Geopolitical Drivers

The ongoing concerns about US recession risks, heightened by the uncertainty surrounding US trade tariffs and Federal Reserve policies, have increased the appeal of gold as a safe-haven asset. Simultaneously, escalating tensions in the Middle East, particularly following failed ceasefire talks in Gaza, further support the demand for gold.

Additionally, the US Dollar’s (USD) slight recovery from a five-month low has created some hesitation among bullish gold traders. Investors are cautiously awaiting the outcome of the Federal Reserve’s policy meeting, set to conclude on Wednesday, which is expected to influence the next significant price movement.

Technical Insights: Key Levels to Watch

From a technical perspective, the $3,000 mark acts as a critical psychological level. While the daily Relative Strength Index (RSI) signals a slightly overbought market, a period of consolidation may precede the next upward surge. Any dip below the immediate $2,980–$2,978 support zone could be a buying opportunity, while a sustained drop below $2,956 might signal a deeper correction toward $2,930.

Conclusion: Outlook and Future Trends

As the market awaits the Federal Reserve’s decision, the outlook for gold remains cautiously optimistic. Should the Fed signal a rate-cutting cycle, the metal may continue its upward momentum. However, a robust US Dollar recovery or easing geopolitical tensions could limit further gains.

Additional Resources:

For more daily gold updates, visit Daily Gold Signal or explore detailed market analyses on the Daily Gold Update.