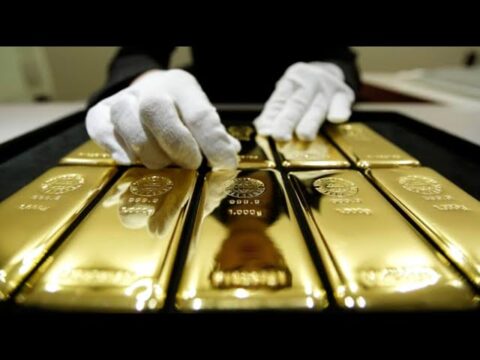

Gold price forecast have shown resilience in early Tuesday trading, with the $3,000 level attracting significant market interest. This key psychological level has become a focal point for traders, as large round figures often serve as critical entry and exit points for institutional investors. Additionally, options markets are paying close attention to these price levels, influencing overall market sentiment.

Key Points for Gold Price:

- Gold prices are rallying as traders focus on the $3,000 level.

- The US dollar’s decline supports continued upside momentum for gold.

- Market participants remain cautious about global trade policies and economic uncertainties.

- Technical indicators suggest further bullish movement toward $3,300.

Gold market trends

The ongoing weakening of the US dollar plays a crucial role in supporting higher gold prices. Investors view gold as a hedge against currency depreciation and inflation, which strengthens its demand. Additionally, ongoing trade policy concerns and geopolitical risks continue to drive safe-haven investments into gold price forecast.

Technical Insights

Should gold prices break below the $3,000 level, traders will likely look at the $2,925 region as the next significant support. This level coincides with the top of the previously broken bullish flag pattern. Based on technical projections, the measured move from this pattern suggests a potential rally toward the $3,300 level. At this time, no significant bearish signals indicate a reversal in the market trend, reinforcing a strong bullish outlook.

Expert Opinions

Market analysts believe that every price pullback in gold presents a buying opportunity. Given the persistent geopolitical concerns and inflationary pressures, gold remains a preferred asset for wealth protection. The consensus among experts is that gold’s upward trajectory remains intact, making it an attractive investment choice in the current market climate.

Conclusion

Gold’s strong momentum and technical indicators point to further price increases. The weakening US dollar, coupled with global economic uncertainties, reinforces the bullish sentiment. As long as these factors persist, gold prices are expected to remain on an upward trend. Investors should continue monitoring key support and resistance levels to make informed trading decisions.

For more updates, visit Daily Gold Signal. For detailed daily gold updates, check out Daily Gold Update.