China open to talks headlines surfaced today, hinting at a potential thaw in tense US-China relations. However, Beijing insists on key diplomatic gestures before any progress in trade negotiations. The markets reacted swiftly, impacting both the US Dollar Index and global gold prices.

Key Takeaways

- China signals openness to negotiations, but with specific diplomatic preconditions.

- Beijing demands respect and consistency from the Trump administration.

- Financial markets reacted with a stronger US Dollar and a slight pullback in gold prices.

Market Context

China’s readiness for fresh trade talks signals a shift, but not without conditions. According to Bloomberg, which cited sources close to China’s government, Beijing is willing to engage diplomatically with the US. Still, their involvement hinges on the tone and consistency of the American approach. These developments come amid heightened geopolitical uncertainty and ongoing economic rivalry between the world’s top two economies.

A major sticking point is the rhetoric coming from Washington. Beijing expects fewer critical comments from top US officials. In addition, China urges the US to clarify its position, particularly regarding sanctions and Taiwan-related matters.

From a strategic standpoint, China wants a designated US representative with presidential backing. This person should help shape a framework that both President Trump and President Xi can agree on when they meet in person.

Technical Insights

The China open to talks announcement had immediate market implications:

- US Dollar Index surged alongside S&P 500 futures, reflecting improved investor sentiment.

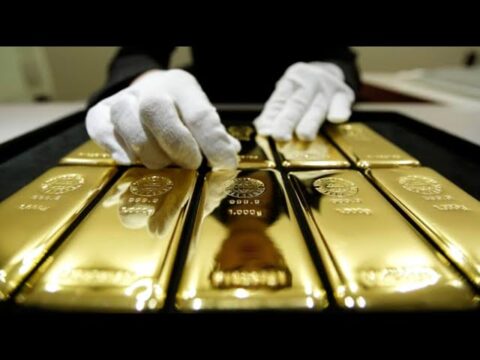

- Gold prices declined from a record high of $3,218 to around $3,200, showing lower risk appetite.

- Analysts view this reaction as temporary unless both nations commit to a long-term agreement.

Markets have grown reactive to geopolitical cues, especially in the absence of clarity over trade policies. Gold’s price movement reflects reduced hedging behavior, with traders anticipating further headlines before making long-term bets.

Expert Opinions

Market analyst Fiona Tan stated, “This shift in tone from China may spark cautious optimism among traders. But without concrete progress, market gains might remain capped.”

Similarly, global trade strategist Daniel Romero emphasized, “The emphasis on respect and structure reflects China’s deeper concerns about trust and credibility in these talks.”

Conclusion

While China open to talks suggests a positive step, the path ahead remains uncertain. Beijing’s diplomatic demands must be met for real progress to happen. Investors should watch for further developments and official confirmations. Until then, the market is likely to stay on edge.

For daily insights on gold and market shifts, check out Daily Gold Signal. Explore Daily Gold Updates for in-depth analysis.

China’s Conditions for Trade Talks with the US

1. Why is China open to trade talks with the US now?

China is open to discussions because it sees an opportunity to stabilize economic relations. However, it has set diplomatic conditions, such as demanding respect and consistency from the US administration.

2. What specific demands has China made before agreeing to negotiate?

China expects the US to reduce hostile rhetoric, clarify its stance on sanctions and Taiwan, and appoint a trusted negotiator backed by the President.

3. How did the markets react to the news about potential US-China talks?

Markets responded positively. The US Dollar strengthened, and gold prices slightly declined from record highs.

4. What impact could renewed US-China talks have on global markets?

If talks progress, global markets may experience improved stability, reduced geopolitical tension, and shifts in commodity prices, especially gold.

5. Where can I find daily updates on gold prices and market trends?

For regular insights and expert analysis, visit Daily Gold Signal.