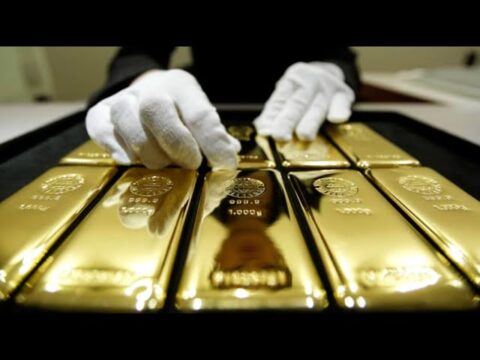

The People Chinese central bank (PBoC) announced that its gold reserves are still 72.8 million ounces (or 2,264 tons) as of the end of September. Carsten Fritsch from Commerzbank noted that the PBoC has not bought any gold in the last five months.

How Do Central Bank Purchases Affect Gold Demand?

This trend shows a change in the gold market and highlights the status of Chinese central bank gold reserves. Earlier this year, the PBoC purchased 29 tons of gold in the first four months, with only small buys in April. In total, the PBoC bought 225 tons of gold last year.

Global Central Bank Purchases Are Strong

Even without the PBoC buying gold, central bank worldwide purchased 483 tons of gold in the first half of this year. Countries like India, Turkey, and Poland are buying a lot of gold, according to the World Gold Council.

What’s Next for Gold Demand?

Some gold purchases can’t be traced to any specific central bank. This suggests that central bank buying will continue to be important for gold demand this year, even without major purchases from China.

Investors are likely to keep a close eye on the actions of other central banks, as they may provide clues about future trends. If other countries continue to increase their gold reserves, it could put upward pressure on gold prices, even if the PBoC remains on the sidelines.

For more insights on gold trends, visit Daily Gold Signal. Stay updated with daily gold news at Daily Gold Update.