Gold market outlook have shown positive movement this week, with solid support around $2,300. However, prices face resistance at $2,400, which could slow further growth. If this resistance is broken, gold prices may rise to $2,500 over time. In the short term, any price dips are likely to find support near $2,300, acting as a foundation for future increases.

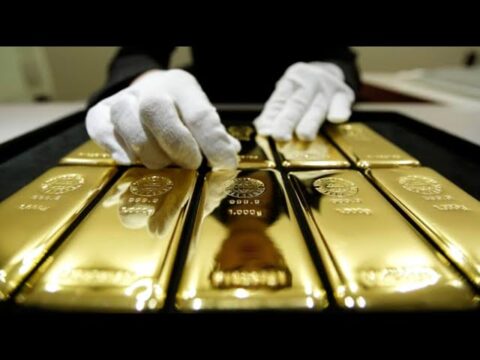

This article discusses the current trends in the gold market and potential price changes.

Relevant Keywords:

- Gold Market Trends

- Gold Price Outlook

- Safe Haven Investment

Current Gold Market Trends

The gold market outlook is trending positively. Prices find strong support at $2,300, which is helping maintain stability. On the other hand, resistance at $2,400 is slowing down further price increases. If this resistance is broken, prices may rise toward the $2,500 target, offering potential gains for investors.

Possible Price Drops

If prices fall, the market might dip to $2,150. This level is significant because it aligns with the 50-week Exponential Moving Average (EMA) and previous resistance levels. However, even in the event of a decline, buying interest is likely to support prices and keep the overall trend positive.

Gold as a Safe Investment (H2)

Gold remains a strong choice for investors during uncertain times. Even with short-term changes, the overall outlook remains positive. Global concerns like debt and geopolitical issues make gold an attractive option. Selling gold during these times doesn’t seem like a good idea, highlighting its importance as a stable investment.

Conclusion

The gold market outlook is positive, with solid support at $2,300 and potential growth if prices break above $2,400. Investors should watch for price dips as possible buying opportunities, considering gold’s role as a safe investment in uncertain times.

For more detailed updates on gold market trends, visit Daily Gold Signal. Stay informed with daily gold updates by checking this page.