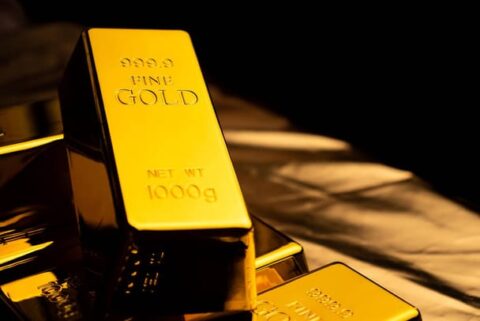

Gold price advances to One-Week high have reflecting a steady increase. The price of gold (XAU/USD) climbed to around $2,439-$2,440 early in the European session. This rise is mainly due to ongoing conflicts in the Middle East and growing expectations of rate cuts by the Federal Reserve (Fed).

Impact of Geopolitical Tensions

Rising tensions in the Middle East have boosted gold’s appeal as a safe-haven asset. Recent events include:

- IDF Intercepts Projectiles: The Israel Defense Forces intercepted about 30 projectiles crossing from Lebanon into northern Israel.

- Increased Military Alert: The Israeli Air Force and Military Intelligence Directorate are on high alert due to potential threats from Western Iran.

- Cease-fire Negotiations: Hamas leaders are urging mediators to use past negotiation plans rather than starting new talks.

- US Military Movements: The US has deployed an additional guided missile submarine to the Middle East in response to escalating tensions.

These developments are contributing to gold’s support amidst growing concerns of a broader conflict in the region.

Technical Outlook for Gold Prices

From a technical standpoint, gold price advances to One-Week high have have recently bounced from the 50-day Simple Moving Average (SMA) support. Oscillators are in positive territory, suggesting a potential bullish trend. Key resistance levels to watch include:

- Resistance Near $2,448-$2,450: Gold may face resistance around this range, and clearing it could lead to a push towards the all-time high of $2,483-$2,484.

- Support Levels: On the downside, the $2,412-$2,410 range offers support, with additional support near the $2,373-$2,372 region. A drop below these levels might lead to further declines, potentially testing the $2,353-$2,352 area and the 100-day SMA.

Conclusion

For the latest updates on gold prices and market trends, visit Daily Gold Signal and explore their Daily Gold Update. Stay informed on how these factors might influence future gold price movements.