Gold price (XAU/USD) attracted some buying interest near the $2,689 level on Monday. However, it failed to maintain momentum and stayed below its recent one-month high during the early European session. A positive market sentiment surrounding equity markets posed challenges for the safe-haven gold, especially as expectations grow that the Federal Reserve (Fed) may halt rate cuts later this month.

Market Awaits Key Events Amid Uncertainty

Traders appear cautious ahead of the inaugural speech of US President-elect Donald Trump. Additionally, the US bank holiday for Martin Luther King Jr. Day has further reduced trading activity. While speculation suggests the Fed may lower rates twice this year due to easing inflation, the US Dollar has struggled to capitalize on recent gains, offering some support to the non-yielding yellow metal.

Gold Prices Gain on Rate Cut Speculations

Gold prices have been climbing for three consecutive weeks, driven by expectations that the Fed might continue reducing interest rates in 2025. Last week’s US Producer Price Index (PPI) and Consumer Price Index (CPI) reports showed signs of easing inflation. Furthermore, Fed Governor Christopher Waller emphasized the likelihood of sustained declines in inflation, which could pave the way for faster rate cuts.

Mixed Sentiments Impact XAU/USD Performance

Despite the USD’s recent struggles and concerns over Trump’s potential trade tariffs, gold prices have remained supported. Optimism surrounding Trump’s potential negotiations with Russia to resolve the Ukraine conflict has also bolstered risk sentiment. However, traders remain cautious ahead of Trump’s address and the Fed’s policy meeting, leading to limited price movement for XAU/USD.

Technical Outlook for Gold Price Movement

From a technical perspective, gold prices may encounter resistance near the $2,715 level and the $2,724-$2,725 region, which represents the recent one-month high. Oscillators on the daily chart show positive momentum, suggesting potential gains toward the $2,745 and $2,760 levels. A further rally could challenge the all-time high of $2,790 set in October 2024.

On the downside, any significant dip below the $2,700-$2,690 support zone might be seen as a buying opportunity. Further declines could extend to the $2,662 level, which serves as a critical support area, reinforced by a short-term ascending trendline and the 100-day Exponential Moving Average (EMA).

US Dollar Performance Today

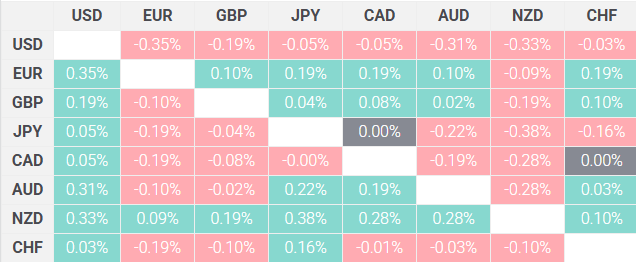

The table below highlights the percentage changes in the US Dollar (USD) against major currencies. Notably, the USD showed strength against the Swiss Franc.

For further daily updates on gold and forex trading signals, visit Daily Gold Signal. Stay informed with the latest market insights and strategies.

Conclusion: Stay Updated for Future Trends

Gold prices face mixed signals as market participants await clarity from major economic and political events. The focus remains on Trump’s policies and their potential impact on inflation and interest rates. Traders should monitor upcoming announcements and technical indicators for strategic positioning.

For in-depth daily updates, check out Daily Gold Updates. Explore insights and stay ahead in the market.