Gold price drop is evident as prices are experiencing a sharp decline., trading in the $2,620 range—more than $50 lower than last week’s close. This drop can be attributed to the strength of the US Dollar, with the trade-weighted US Dollar Index (DXY) rising nearly half a percent. The speculation that President Donald Trump’s economic policies will favor the US Dollar is a significant factor. Since gold is priced in USD, a stronger dollar generally causes its price to decrease.

Gold Price Drop: Impact of Trump’s Economic Policies on the Dollar

Trump’s economic strategies, particularly his advocacy for tariffs, have led to an increase in inflation expectations. While tariffs alone may not strengthen the US Dollar, they influence the US Federal Reserve’s actions. The expectation is that the Federal Reserve will slow down interest rate cuts due to inflation concerns. Higher interest rates tend to attract more foreign investment, positively impacting the US Dollar. Additionally, Trump’s tax cuts are expected to further fuel inflation, supporting a stronger Dollar.

Gold price drop driven by rumors of Robert Lighthizer’s appointment

Gold prices are under further pressure due to rumors surrounding the appointment of Robert Lighthizer as the US Trade Representative. Lighthizer, a strong advocate for protectionist policies, is known for his tough stance on China. This speculation, first reported by the Financial Times, may signal more protectionist economic policies, which could have implications for both the US economy and gold.

Political Climate and Its Impact on Gold

With Trump’s party holding significant power in the White House, Senate, and potentially Congress, his economic agenda, including tax cuts, seems likely to be implemented. These developments could boost the US Dollar further, making gold less attractive to investors. Additionally, the rise of alternative assets like Bitcoin, which hit a new all-time high, may also reduce demand for gold as investors seek riskier assets with potentially higher returns.

The Effect of Geopolitical Factors on Gold Demand

Trump’s promise to end the Ukraine-Russia war quickly has further dampened the demand for gold as a safe-haven asset. As geopolitical tensions ease, investors may have less need for gold, which traditionally thrives during times of uncertainty.

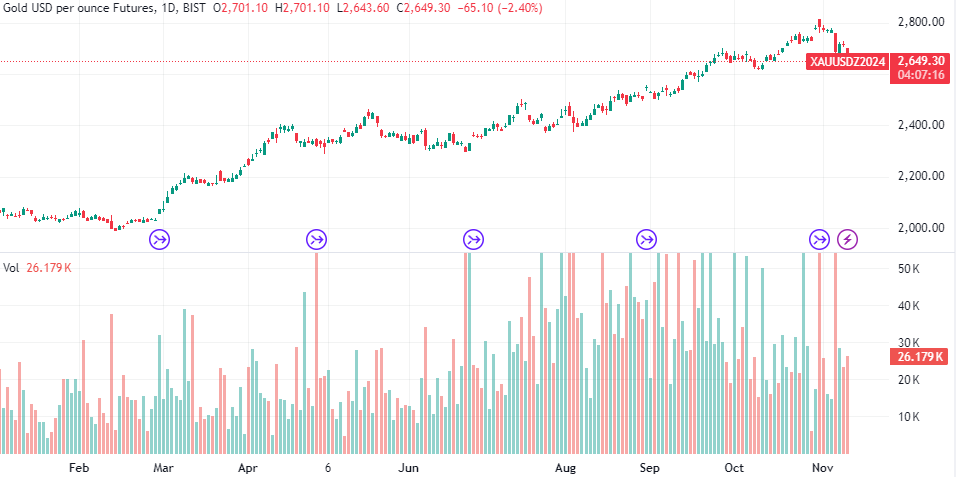

XAU/USD Technical Analysis and Short-Term Outlook

From a technical standpoint, gold has resumed its downward trend after a brief recovery in November. Breaking below the $2,643 level indicates a bearish continuation, with a potential target at the $2,605 support level. While gold is not yet oversold, suggesting room for further decline, its long-term uptrend remains intact. It’s possible that gold could rebound once the broader market cycles shift.

Conclusion

The gold price drop is under pressure from a stronger US Dollar and the expectations surrounding Donald Trump’s economic policies. The combination of tariffs, tax cuts, and protectionist stances is contributing to a positive outlook for the US Dollar. Additionally, rumors of Robert Lighthizer’s appointment and the rise of alternative assets like Bitcoin are further limiting gold’s appeal. Despite the short-term downtrend, gold’s long-term outlook remains uncertain, and its price may eventually recover.

For more updates on gold prices and market trends, visit Daily Gold Signal. Stay informed with the latest Daily Gold Updates.