Gold price dips (XAU/USD) slipped on Wednesday, ending a three-day rise as the US Dollar slightly rebounded. Statements from Federal Reserve officials and strong US economic data have dampened hopes for a September rate cut. The US Dollar strengthened, which put downward pressure on gold prices. However, geopolitical risks and ongoing global uncertainty could continue to drive demand for gold as a secure investment. Furthermore, ongoing gold purchases by central banks are expected to maintain upward pressure on prices.

Fed News Drives Gold Market Movement

On Wednesday, traders will closely follow the Federal Reserve’s Beige Book report and a speech by John Williams. The key event later this week will be Friday’s US Core Personal Consumption Expenditures (Core PCE) Price Index. Analysts predict this report will show a monthly increase of 0.3% and a yearly rise of 2.8%. If inflation remains persistent, this could lead the Fed to delay rate cuts, causing further declines in gold prices due to the rising opportunity costs tied to higher interest rates.

Daily Market Overview: Fed Remarks Affect Gold Price

International events also impact gold price dips. Israeli Prime Minister Benjamin Netanyahu has vowed to continue military actions despite global backlash over an airstrike that recently killed 45 people in Rafah. On the gold front, the World Gold Council reported a net outflow of 11.3 metric tonnes from global gold-backed ETFs last week.

UBS analysts have increased their gold price predictions to $2,500 per ounce by September and $2,600 by year-end. These forecasts are above their previous estimates of $2,400 and $2,500.

US consumer confidence slightly improved in May, reaching 102.0 from April’s 97.0, surpassing the expected 95.9 figure. However, comments from Fed officials remain a primary focus. Governor Michelle Bowman expressed caution, preferring a slower pace in quantitative tightening. Meanwhile, Minneapolis Fed President Neel Kashkari emphasized the need to wait for clear progress on inflation before lowering interest rates, suggesting only two rate cuts in 2024.

Technical View: Long-Term Bullish Outlook for Gold

Gold prices may be experiencing a slight pullback, but the long-term technical outlook remains positive. The price is holding above the 100-day Exponential Moving Average (EMA) on the 1-hour chart, maintaining a bullish tone. However, the 14-day Relative Strength Index (RSI) sits near 50, indicating some consolidation or indecision in the short term.

The first upside target is $2,427, the upper limit of the Bollinger Band. A continued upward push could break past this level, potentially driving gold toward the psychological mark of $2,500. If the market turns bearish, initial support lies at $2,325, followed by the next level of $2,300. Further declines could find support near $2,277, with the 100-day EMA at $2,222 serving as a critical level.

Dollar Value Today

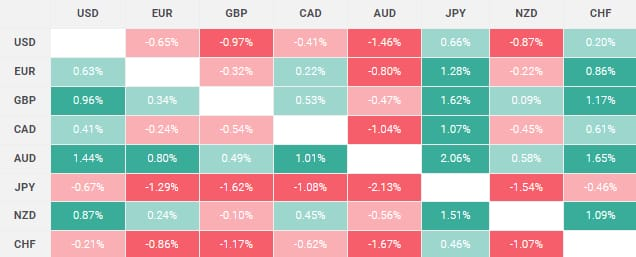

The table below highlights the changes in US Dollar value against major currencies, with the New Zealand Dollar showing the most significant shift. A heatmap further illustrates percentage changes, helping traders compare currency strengths.

Conclusion

Gold prices remain sensitive to Federal Reserve policy changes, with ongoing inflation concerns impacting future rate cuts. Investors should monitor these developments and other geopolitical factors closely, as they will significantly affect the gold market in the coming months. For daily updates on gold prices, check the Daily Gold Signal website. You can also explore daily gold updates for the latest market insights.