The gold price (XAU/USD) faced a pullback on Wednesday, driven by a modest recovery in the US Dollar (USD). Despite this dip, ongoing geopolitical tensions in the Middle East may help stabilize gold, limiting further losses. Additionally, the recent speech by US Federal Reserve (Fed) Chair Jerome Powell at the Jackson Hole symposium hinted at a potential shift towards lower interest rates, which could provide support for gold. Lower interest rates generally decrease the cost of holding assets that don’t earn interest, such as gold, making them more appealing to investors.

Key Influences on Gold Price

Investors are keeping a close eye on the speeches of Fed officials Christopher Waller and Raphael Bostic on Wednesday for insights into future US interest rate decisions. Attention will then shift to critical US economic data later in the week, including the second estimate of Q2 Gross Domestic Product (GDP) and the Personal Consumption Expenditures (PCE) Price Index. If these indicators outperform expectations, the USD could strengthen, potentially capping gains for gold.

Market Overview: Gold Loses Momentum as Fed Rate Cuts Loom

Despite recent weakness, the prospect of falling interest rates is attracting investors back to gold. According to reports, Gold Exchange-Traded Fund (ETF) holdings rose by 15 tonnes last week, marking the highest level in six months. Speculative interest also surged, with net long positions reaching around 193,000 contracts as of August 20th, the highest level in nearly four and a half years.

Meanwhile, the US Consumer Confidence Index climbed to a six-month high in August, reaching 103.3, up from 101.9 in July. In contrast, the US Housing Price Index slightly dipped by 0.1% month-over-month in June, defying expectations of a 0.2% rise.

Technical Analysis: Gold Maintains Long-Term Bullish Outlook

Despite the recent decline, the longer-term outlook for gold remains positive. The metal continues to trade above the 100-day Exponential Moving Average (EMA) on the daily chart, indicating ongoing upward momentum. Additionally, the 14-day Relative Strength Index (RSI) remains above the midline at 64.70, suggesting continued bullish pressure in the near term.

Key resistance for XAU/USD is at $2,530, representing the confluence of the all-time high and the upper boundary of the ascending channel. A breakout above this level could propel gold towards the psychological $2,600 mark. On the downside, support is seen at $2,500, with further declines potentially testing the $2,470 and $2,432 levels.

External Factors: How the US Dollar Has Performed Recently

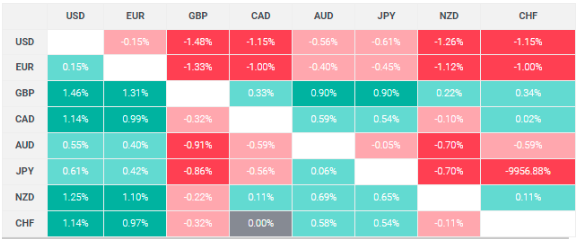

The value of the US Dollar directly influences gold prices. Over the last seven days, the USD has shown strength, particularly against the Euro. This recovery in the USD is another factor that has contributed to the recent decline in gold prices.

For more updates on gold prices and market analysis, check out our latest reports on Daily Gold Signal. Additionally, stay informed with our detailed daily gold updates.