Gold price forecast (XAU/USD) reached an all-time high of $3,057 before experiencing a slight decline of 0.50%, settling around $3,041 as of Thursday. Despite profit-taking pressures, the earlier price surge followed the Federal Reserve’s (Fed) decision to maintain interest rates at 4.25%-4.50%. Fed Chairman Jerome Powell emphasized that tariffs would only delay the inflation target timeline, reinforcing investor sentiment.

Key Takeaways for Gold Price:

- Gold hit a new all-time high at $3,057 before slightly retreating.

- The Federal Reserve kept interest rates unchanged, citing inflationary concerns.

- Geopolitical tensions in Gaza and Turkey contribute to gold’s market movements.

- Swiss gold exports to the US remained high, signaling strong demand.

Market Context: Geopolitical Market Impact

Geopolitical tensions remain heightened, particularly in Gaza, where Israeli strikes persist, urging civilians to relocate ahead of potential ground operations. Simultaneously, mass protests erupted in Turkey following the detention of Istanbul Mayor Ekrem Imamoglu, the primary political opponent of President Erdogan. These developments increase global uncertainty, leading investors to seek gold as a safe-haven asset.

On the economic front, Chairman Powell acknowledged the possibility of a recession, stating that inflationary effects from tariffs could be transitory. However, he noted the difficulty in precisely determining inflation drivers. Bloomberg reports that Swiss gold exports to the US were robust in February, totaling 147.4 tons and exceeding $14 billion in value.

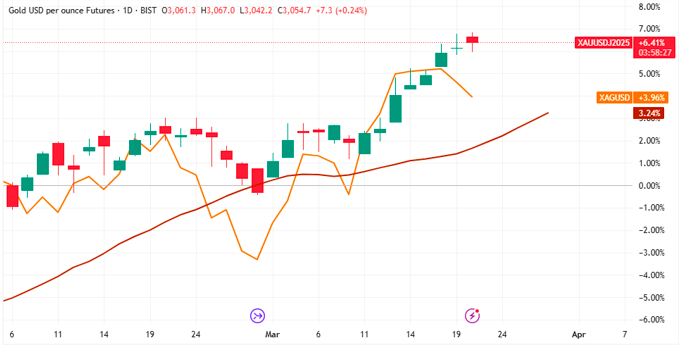

Technical Analysis: Gold Price Forecast and Market Sentiment

Gold price forecast continues to follow a strong bullish trend, with traders capitalizing on every price dip. The pattern observed earlier in the week suggests sustained buying interest, but a potential squeeze could disrupt short-term positioning.

Resistance Levels:

- R1: $3,058 (Immediate Resistance)

- R2: $3,069 (Next Target Above $3,060 Round Level)

Support Levels:

- Pivot Point: $3,040 (First Support Zone)

- S1: $3,030 (Secondary Support)

- S2: $3,000 (Psychological Level)

Expert Insights and Market Outlook

Chinese financial media warn investors of potential gold price volatility, advising against blindly chasing highs. The China Securities Journal highlights ongoing geopolitical uncertainties and an evolving global economic landscape as key risk factors. Bloomberg further suggests that investors should diversify assets and mitigate risks strategically.

Conclusion

Gold remains resilient despite minor profit-taking, with bullish sentiment supported by geopolitical risks and strong market demand. Traders continue to monitor technical levels, with $3,057 serving as the primary resistance to beat. Given sustained uncertainties, gold’s trajectory will depend on macroeconomic developments and Fed policy signals.

Explore more insights into the gold market by visiting Daily Gold Signal. Stay updated with daily analysis at Daily Gold Update.