Gold price movements have shown a decline early in the European session on Monday. The commodity is close to its highest level since May 22 and appears set to appreciate further due to expectations of a dovish Federal Reserve (Fed). Market participants believe the Fed will start cutting interest rates in September, which is seen as positive for the gold price.

2. Factors Influencing Gold Price

2.1 Federal Reserve’s Expected Rate Cuts

The market anticipates the Fed will lower borrowing costs in December, which has not helped the US Dollar (USD) capitalize on its modest recovery from a three-month low. This situation supports the gold price as gold is denominated in USD. The expectation of rate cuts arises from signs of slowing inflation and economic growth, prompting the Fed to adopt a more accommodative monetary policy.

Global Economic Indicators

Global economic indicators significantly influence gold price. Recent economic data from China pointed to slower growth, increasing economic uncertainty. The National Bureau of Statistics (NBS) reported that China’s economy grew by 4.7% in the second quarter of 2024, down from 5.3% in the first quarter. Furthermore, China’s retail sales and fixed asset investment figures fell below expectations, highlighting ongoing economic concerns.

Daily Market Movers

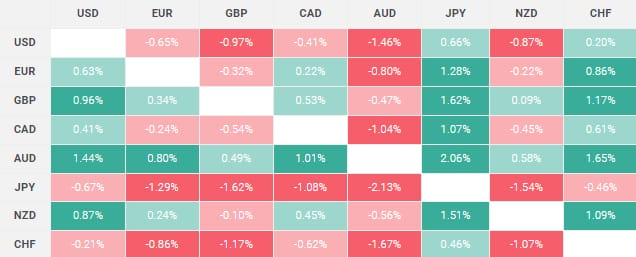

US Dollar’s Recent Movements

On Monday, the USD attracted some buyers, reversing part of its recent losses. This exerted pressure on gold price movements for the second straight day. Data from the US Bureau of Labor Statistics showed the Producer Price Index (PPI) for final demand rose by 2.6% in June, exceeding the expected 2.3%. Higher PPI figures can strengthen the USD, which negatively affects gold price movements.

Political Uncertainty and Federal Reserve Expectations

Political uncertainty in the US, alongside expectations of a dovish Fed, may limit gains for the USD. The market sees a 90% chance the Fed will start cutting rates in September, following a tame US consumer inflation report. Lower inflation reduces the likelihood of aggressive rate hikes, generally supporting gold price movements.

China’s Economic Data

The National Bureau of Statistics (NBS) reported that China’s economy grew by 4.7% in Q2 2024, down from 5.3% in Q1. Additionally, China’s retail sales and fixed asset investment figures fell short of expectations, highlighting economic uncertainty. This data contributes to fluctuations in gold price movements as investors react to global trends.

Technical Analysis of Gold Price Movements

Trends and Support Levels

From a technical perspective, gold found strong support near the $2,390-$2,388 level. Oscillators on the daily chart are positive, indicating that the path of least resistance for gold price movements is upward. A drop below $2,400 could present a buying opportunity. Conversely, gold prices might fall to the $2,358 region, with support around $2,372-$2,371.

Resistance Levels

Last week’s high around $2,425 serves as an immediate hurdle for gold price movements. If prices surpass this level, they may aim for the all-time peak near $2,450, reached in May. Sustained strength beyond this point could trigger further bullish moves in gold.

Monitoring Technical Levels

On the downside, the $2,390-$2,388 region acts as critical support. If breached, the next support level is $2,358, with intermediate support at $2,372-$2,371. The 50-day Simple Moving Average (SMA) near the $2,350 region also serves as crucial support for gold price.

Impact of Macroeconomic Events on Gold Price Movements

Key Economic Data Releases

The release of significant economic data, such as the Empire State Manufacturing Index and speeches by Fed officials, can considerably influence gold price movements. For instance, comments from Fed Chair Jerome Powell regarding monetary policy and the economic outlook are closely monitored by market participants.

Geopolitical Events

Geopolitical events, including tensions in the Middle East and trade disputes, can also impact gold price movements. Such events often drive investors toward safe-haven assets like gold, leading to price spikes during periods of heightened uncertainty.

Conclusion

In conclusion, gold price movements are influenced by various factors, including Federal Reserve policies, US political and economic conditions, global economic indicators, and technical levels. Understanding these dynamics is essential for traders and investors navigating the gold market.

For daily updates on gold prices, visit Daily Gold Signal. For more detailed daily gold updates, check out Daily Gold Updates.