Gold price forecast have shown resilience recently, despite some fluctuations in the market. The $2,480 level has acted as a crucial support point for the precious metal. While the market isn’t expected to skyrocket, this support level suggests a potential long-term opportunity for investors. The focus now is on whether gold has the momentum to continue its upward trend. In this article, we’ll explore the factors influencing gold’s price movement and what investors can expect.

Current Gold Market Overview

The gold market initially experienced a decline on Wednesday, but the $2,480 level provided strong support. This level is crucial as it could pave the way for a long-term buying opportunity. While gold isn’t expected to rise sharply, it seems to be stabilizing, waiting for a clear direction.

Factors Supporting Gold Prices

Several factors could contribute to a rally in gold price forecast. One significant factor is the potential drop in interest rates, which tends to boost gold’s appeal. Additionally, geopolitical tensions can drive investors toward the safety of gold. However, a strengthening US dollar has recently created some headwinds for the gold market. Although both gold and the dollar can rise together during economic uncertainty, the dollar’s recent gains have slowed gold’s momentum.

The Role of Central Banks

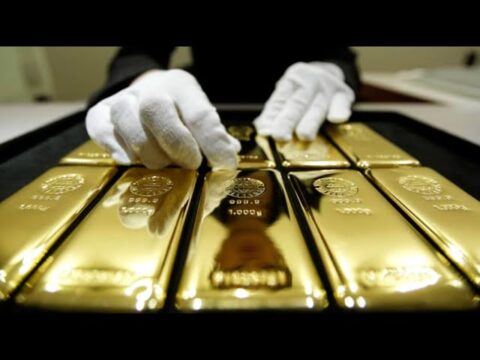

Central banks around the world have been increasing their gold reserves, providing additional support for gold prices. This central bank activity acts as a safety net for gold, preventing significant price drops. Moreover, the ongoing uptrend in gold suggests that the market remains positive, with no signs of a sudden reversal.

What Lies Ahead for Gold?

Looking ahead, gold is expected to maintain its upward trajectory. Economic challenges could further boost gold prices, making it a solid choice for investors seeking stability. The combination of central bank purchases, geopolitical concerns, and potential interest rate cuts all point to a favorable environment for gold.

Conclusion

In summary, gold continues to look well-supported, with the $2,480 level acting as a crucial foundation. Investors should keep an eye on interest rates, the US dollar’s performance, and central bank activities as they consider their next move in the gold market. For more detailed updates on gold price trends, check out the Daily Gold Update. To stay updated on the latest signals and trends in the gold market, visit Daily Gold Signal.