Gold price (XAU/USD) has managed to recovers part of its intraday losses, trading with a slightly negative bias near the $2,760 area during the European session on Monday. Renewed trade war concerns, triggered by the US President’s decision to impose tariffs on imports from Colombia, have fueled global risk aversion and supported the yellow metal. Additionally, declining US Treasury bond yields, driven by expectations that the Federal Reserve (Fed) might lower interest rates twice this year, have further bolstered gold’s appeal as a safe-haven asset.

However, the US Dollar (USD) has rebounded from its recent low, which may discourage fresh bullish positions on gold. Despite this, the current economic conditions remain favorable for XAU/USD bulls, hinting that gold might soon challenge its all-time high near the $2,790 mark. Investors are now closely monitoring US economic data for further insights.

Gold Price Supported by Risk-Off Sentiment and Fed Rate Cut Speculation

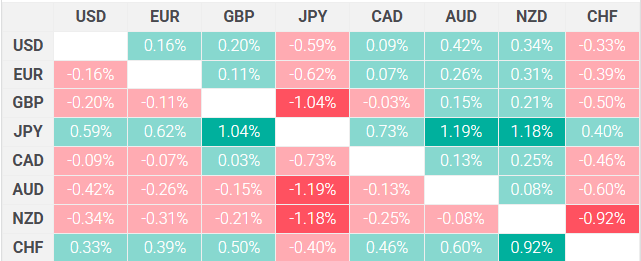

The US Dollar Index (DXY), which tracks the USD against a basket of currencies, has risen by nearly 0.25%. This recovery stems from heightened concerns about US trade policies, prompting some selling pressure on gold price recovers. On Monday, President Trump announced a 25% emergency tariff on all Colombian imports after the country refused to permit US military planes carrying deported migrants to land.

These tariffs, potentially increasing to 50% next week, reignited fears of a trade war, reducing investors’ appetite for riskier assets. Additionally, reports suggest the Trump administration is considering similar tariffs on Mexico and Canada by February 1, further escalating trade tensions.

The White House confirmed on Monday that Colombia has agreed to comply with all US demands, including the unrestricted acceptance of deported individuals. Meanwhile, Trump’s recent comments advocating for immediate interest rate cuts have increased expectations of further monetary easing in 2025, dragging US Treasury bond yields lower. While this could weigh on the USD, it simultaneously provides some support to gold prices.

Key Levels and Market Outlook for Gold Prices

Gold remains well-positioned to retest its all-time high near the $2,790 region. A decline below the $2,750-2,748 area might find support at $2,736, with additional key levels at $2,725-2,720. Breaking below these levels could trigger further technical selling, pushing prices below $2,700 to the $2,665-2,662 zone.

On the upside, sustained momentum beyond $2,772-2,773 could pave the way for a move back to $2,790. Further buying interest above $2,800 would likely act as a catalyst for bullish traders, potentially extending the rally to new highs.

Market Drivers to Watch

Traders are keeping a close eye on several key US economic releases, including Durable Goods Orders, the Consumer Confidence Index, and the Richmond Manufacturing Index. These reports may provide fresh insights into the economic outlook and influence gold’s trajectory in the short term.

For more insights, visit our Daily Gold Signal page or explore our Daily Gold Updates for the latest market trends and forecasts.