The gold price softens has softened, reflecting the influence of a strong US Dollar and economic worries. As of Monday, the price of gold (XAU/USD) dipped near the $2,500 mark, largely due to the robust US Dollar, which gained strength after the release of the US July Personal Consumption Expenditures (PCE) Index. Additionally, concerns about China’s slowing economy, a key buyer of gold, have added to the downward pressure on the precious metal.

However, with rising expectations of a rate cut by the US Federal Reserve (Fed) in its upcoming September meeting, gold’s decline may be cushioned. Lower interest rates generally decrease the opportunity cost of holding assets that don’t generate yields, such as gold. Looking ahead, the focus will be on key US economic data, including the ISM Manufacturing PMI and Services PMI, along with the all-important employment data set to be released later this week.

Market Movers: Gold Price Reaction to US PCE Data

Gold price softens took a hit after the release of the US PCE inflation report. The PCE Price Index, which measures consumer spending, rose 2.5% year-over-year in July, in line with the previous reading but slightly below market expectations. The core PCE, excluding volatile food and energy prices, increased by 2.6% year-over-year, also falling short of the anticipated 2.7%.

The economic data has fueled speculation about the Federal Reserve’s next move, with markets now pricing in a nearly 70% chance of a 25 basis point rate cut in September. While this has weighed on gold prices in the short term, the potential for lower interest rates could provide support for the precious metal going forward.

Technical Analysis: Gold’s Broader Bullish Outlook Intact

Despite recent declines, the broader outlook for gold remains constructive. On the daily chart, gold continues to trade above its key 100-day Exponential Moving Average (EMA), indicating that the overall bullish trend is intact. The 14-day Relative Strength Index (RSI) stands at 56.30, suggesting that the path of least resistance for gold is still to the upside.

Gold bulls will need to overcome the five-month-old ascending channel’s upper boundary and the all-time high of $2,530-$2,540 to push prices higher. A breakout above this level could pave the way for a move towards the $2,600 psychological mark. On the downside, initial support is seen at $2,470, with further losses likely targeting $2,432 and $2,372, the latter being the 100-day EMA.

The Effect of the US Dollar on Gold Prices

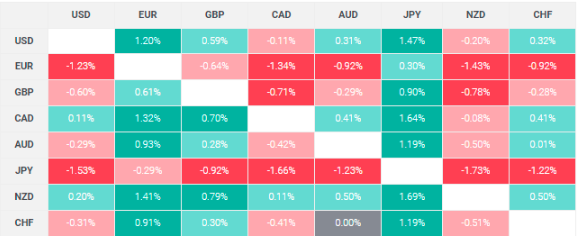

The strength of the US Dollar has been a significant factor in gold’s recent decline. Over the past seven days, the US Dollar has outperformed several major currencies, particularly the Japanese Yen. This strength has made gold, priced in US Dollars, more expensive for buyers using other currencies, contributing to the metal’s recent weakness.

The currency heatmap highlights the percentage changes between the US Dollar and other major currencies. This relationship between gold and the US Dollar is an important dynamic for traders and investors to monitor, as it can significantly influence gold price movements.

Conclusion

While the gold price has softened amid a stronger US Dollar and concerns over China’s economy, the downside seems limited due to expectations of a US Federal Reserve rate cut. Key US economic data due this week will be crucial in determining the next move for gold prices.

For those looking to stay informed on daily gold updates, check out this Daily Gold Update for the latest market analysis. For more insights and trading signals, visit Daily Gold Signal.