Gold price, tracked as XAU/USD, lost a significant portion of their intraday gains but remained above the $2,660 level in early European trading on Tuesday. Factors like a steady US Dollar and geopolitical tensions are influencing its movement. Meanwhile, market participants remain focused on potential interest rate adjustments by the Federal Reserve.

Gold Price Faces Pressure from US Dollar Strength

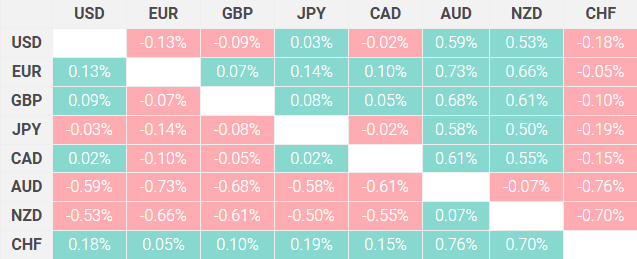

A firmer US Dollar, buoyed by expectations of the Federal Reserve’s cautious stance on rate cuts, is weighing on the gold price. The USD rebounded from a one-month low, limiting gold’s upward momentum. However, the possibility of the Fed lowering borrowing costs soon has helped keep US Treasury bond yields suppressed, offering some relief to the non-yielding yellow metal.

Geopolitical Tensions and Central Bank Activity Bolster Gold

Global instability, including the worsening Russia-Ukraine conflict and unrest in South Korea and France, is fueling demand for gold as a safe-haven asset. Additionally, China’s central bank resumed gold purchases after a seven-month pause, providing further support to the market.

The situation in the Middle East escalated after Syrian rebels gained control, driving haven flows towards gold. These geopolitical concerns, coupled with economic uncertainties, are likely to limit significant declines in gold prices.

Technical Analysis – Key Levels to Watch

Technically, the gold price recently broke above the $2,650 barrier, signaling potential for further upside. If the price sustains above this level, it could target the $2,700 mark and potentially the $2,720 resistance zone.

On the other hand, falling below $2,650 may reveal the support zone around $2,625-2,620. A deeper correction might see prices test the November lows near $2,537. Traders are closely monitoring these levels for future price movements.

Key Event Ahead – US Consumer Price Index

This week’s highlight is the upcoming release of the US Consumer Price Index (CPI) for November on Wednesday. The data will provide insights into inflation trends and influence the Federal Reserve’s policy decisions. This development will play a critical role in shaping gold price trends.

Conclusion

The gold price continues to navigate between pressures from a stronger US Dollar and support from geopolitical risks. While short-term fluctuations persist, the outlook remains optimistic, with key levels and upcoming economic data driving market sentiment.

For daily updates on the gold market, visit our Daily Gold Update. Stay informed with our in-depth analyses at Daily Gold Signal.