Gold prices in Pakistan dropped significantly on Friday, reflecting both domestic shifts and global market trends.

Key Highlights for Gold Price

- The price of 24-karat gold dropped by Rs3,300, bringing it down to Rs348,700 per tola.

- 10-gram 24-karat gold dipped Rs2,833, reaching Rs298,950.

- 22-karat gold per 10-gram is now at Rs274,047.

- Silver saw gains, climbing Rs40 per tola to reach Rs3,497.

- Global spot gold declined 1.63%, settling near $3,294 per ounce.

Gold Price Trends: Market Overview and Economic Context

The drop in gold prices in Pakistan comes at a time when the global market is reacting to improving geopolitical sentiment. Spot gold declined by over 1% on Friday, shedding $54.6 over the course of the session. This move was largely triggered by news that China has lifted tariffs on selected U.S. goods, raising expectations of easing trade tensions between the two leading global economies.

Such developments typically impact gold prices, as the precious metal is often seen as a hedge during uncertain times. When tensions ease, investor appetite for gold weakens, pulling down prices.

At the same time, local demand dynamics and exchange rate movements have contributed to the domestic price decrease, even as silver registered a moderate gain. The All-Pakistan Gems and Jewelers Sarafa Association (APGJSA) suggests the downward trend could indicate wider changes in investor sentiment.

For real-time updates and expert gold trading insights, visit Daily Gold Signal.

Gold Rate Today: Technical Market Analysis

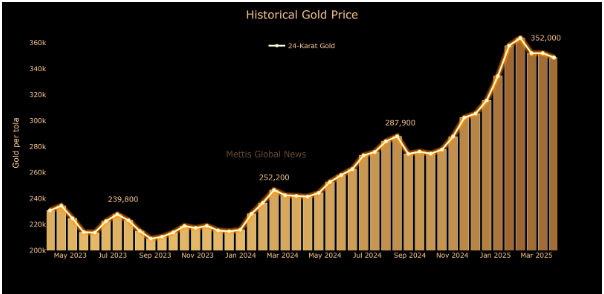

From a technical perspective, gold has breached a short-term support level after failing to hold above Rs352,000 per tola. The next potential support lies around Rs345,000, with resistance at Rs355,000. The 10-day moving average shows a downtrend, suggesting a bearish short-term outlook.

Internationally, the price decline aligns with profit-taking behavior and a stronger U.S. dollar. Traders are now closely watching inflation data and upcoming U.S. Federal Reserve decisions, which could further sway precious metal markets.

Silver, on the other hand, shows contrasting momentum. Its price movement suggests growing demand from industrial sectors and speculative interest, especially as gold retreats.

Pakistan Gold Market: Expert Opinion and Outlook

Analyst Fahad Khan, a market strategist at Karachi Bullion Exchange, stated, “The drop is a natural correction after weeks of strong upward momentum. Global cues and easing tensions are now pushing investors to take profits.”

Looking ahead, gold could face further downward pressure if diplomatic progress continues and U.S. economic data remains stable. However, any re-emergence of uncertainty could quickly reverse the trend.

Conclusion

Gold prices in Pakistan have experienced a significant decline driven by both international and domestic market factors. While global spot prices fell on easing trade tensions, domestic factors like currency fluctuation also played a role. Investors are advised to stay alert and monitor upcoming economic announcements for more clues on future price movements.

For more detailed updates and daily gold market analysis, check out the Daily Gold Update.

FAQs About Gold Price in Pakistan

1. Why did the gold price in Pakistan drop today?

The gold price in Pakistan dropped due to a combination of global market trends and local economic factors. Internationally, easing trade tensions between the U.S. and China reduced demand for safe-haven assets like gold.

2. How much did the 24-karat gold price fall in Pakistan?

The price of 24-karat gold fell by Rs3,300 per tola, now standing at Rs348,700 in the local market.

3. What is the current price of 10-gram 24-karat gold in Pakistan?

As of today, 10 grams of 24-karat gold is priced at Rs298,950, reflecting a drop of Rs2,833.

4. Did silver prices also decrease like gold?

No, silver prices actually increased. 24-karat silver rose by Rs40 per tola, reaching Rs3,497.

5. What global factors influenced gold prices today?

Spot gold prices declined globally due to reduced geopolitical tensions. China's decision to lift some tariffs on U.S. goods led to a drop in gold demand, as investors moved away from safe-haven assets.

6. Is this a good time to invest in gold in Pakistan?

Investment decisions should consider both technical analysis and market context. With current price corrections and market volatility, many investors see this dip as a potential buying opportunity, but expert advice is recommended.