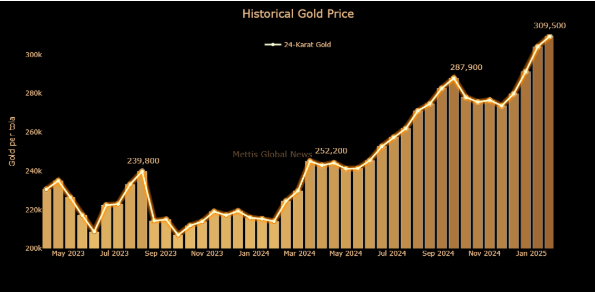

The gold price in Pakistan experienced a notable uptick on Monday, with 24-karat gold climbing to Rs309,500 per tola. This represents an increase of Rs1,500 from the previous day. Additionally, 24-karat gold per 10-gram rose to Rs265,346, marking a gain of Rs1,286.

The All-Pakistan Gems and Jewelers Sarafa Association (APGJSA) reported that 22-karat gold also saw an upward trend, priced at Rs243,242 per 10-gram. Silver prices followed a similar trajectory, with 24-karat silver reaching Rs3,395 per tola and Rs2,910 per 10-gram.

Key Highlights

- 24-karat gold surged to Rs309,500 per tola, up by Rs1,500.

- 24-karat gold per 10-gram increased to Rs265,346, gaining Rs1,286.

- 22-karat gold rose to Rs243,242 per 10-gram.

- Silver prices climbed to Rs3,395 per tola and Rs2,910 per 10-gram.

- Global spot gold traded near $2,944 an ounce, up 0.26%.

Understanding the Gold Price Surge

Global Market Dynamics

Globally, spot gold traded near $2,944 an ounce, reflecting a 0.26% increase from the previous session. This rise is largely due to a weaker U.S. dollar and heightened anticipation around the upcoming U.S. inflation report.

Gold prices have been hovering near record highs, fueled by economic uncertainties and geopolitical tensions. As a safe-haven asset, gold tends to attract investors during periods of market instability, contributing to its recent price rally.

Analyzing Market Trends

Key Support and Resistance Levels

In Pakistan, gold prices have shown consistent upward momentum, with support levels around Rs308,000 per tola. Resistance levels are currently near Rs310,000 per tola, which could be tested if the upward trend persists.

Moving Averages and Technical Indicators

The 50-day moving average for gold price in Pakistan indicates a bullish trend, supported by strong demand in both domestic and international markets. Technical indicators suggest that gold prices may continue to rise in the short term, especially if global economic conditions remain uncertain.

Expert Perspectives

Market analysts attribute the rise in gold prices to broader economic trends. “The weakening U.S. dollar and upcoming inflation data are key drivers of gold’s current performance,” says a senior economist at Daily Gold Signal.

Experts also emphasize the role of geopolitical tensions and central bank policies in shaping gold prices. For more detailed updates, visit Daily Gold Update.

Final Thoughts

The gold price in Pakistan has surged by Rs1,500 per tola, driven by both domestic demand and global market trends. With the U.S. dollar weakening and key economic data on the horizon, gold prices are likely to remain volatile in the coming days.

Investors and traders should monitor market developments and technical indicators closely to make informed decisions. For the latest updates and expert insights, visit Daily Gold Signal.