Gold price forecast (XAU/USD) struggled to gain traction during the Asian session on Monday, hovering around the three-week low seen last Friday. The market is being influenced by a combination of factors, such as growing expectations that the Federal Reserve may cut interest rates later this year due to easing inflation in the US. This scenario is weakening the US Dollar (USD) and providing some support for gold as a safe-haven asset.

However, the potential for a significant rise in gold price forecast is limited by a generally positive market sentiment, fueled by optimism for a ceasefire in Gaza. Many traders are waiting for key US economic data, including Friday’s Nonfarm Payrolls (NFP) report. The market also has its eyes on central bank decisions, such as the Bank of Canada’s policy announcement on Wednesday and the European Central Bank (ECB) meeting on Thursday, which could affect gold’s performance.

Daily Market Overview: Gold Faces Challenges Despite Weakening USD

The latest US inflation data met expectations, reinforcing the belief that the Federal Reserve might cut rates later this year. This has weakened the US Dollar and provided a lift to gold prices. On Friday, the US Bureau of Economic Analysis (BEA) reported that the Personal Consumption Expenditures (PCE) Price Index rose by 0.3% in April, maintaining an annual rate of 2.7%, in line with market predictions.

Similarly, the Core PCE Price Index, which excludes volatile food and energy prices, increased by 2.8% year-over-year. Personal Income and Spending also rose slightly by 0.3% and 0.2%, respectively. This data supports the case for a Federal Reserve rate cut, which in turn has caused US Treasury bond yields to drop, leaving USD bulls defensive and supporting gold prices.

Tensions in the Middle East are also providing some support to gold. However, the generally positive mood in equity markets is capping significant upward movements in gold prices.

Global Economic Developments and Their Impact on Gold

China’s Caixin S&P Global Manufacturing PMI increased to 51.7 in May, signaling stabilization in the world’s second-largest economy and boosting investor confidence. Additionally, optimism around a ceasefire plan for Gaza, proposed by US President Joe Biden, is preventing traders from making aggressive bullish moves in gold.

Market participants are now looking forward to the final global Manufacturing PMI data, followed by the US ISM Manufacturing PMI later today, for short-term trading cues. The focus will also be on other important US macroeconomic data this week, such as the NFP report, along with key central bank events like the Bank of Canada and ECB meetings.

Technical Analysis: Potential Gold Price Movements

Technically, if gold prices fall below the $2,320 support level, it could signal a more significant downturn. A breakdown through the 50-day Simple Moving Average (SMA) could lead to deeper losses. Oscillators on the daily chart are showing negative momentum, suggesting that gold may drop below $2,300, possibly testing the next support zone around $2,285-$2,284.

On the upside, if gold manages to climb past the $2,343-$2,344 resistance area, it could face further resistance near the $2,360 level, which was last Friday’s high. Continued buying beyond $2,364 could trigger more bullish activity, pushing gold towards $2,385 and potentially even $2,400. If this momentum continues, gold might reach the $2,425 to $2,450 range, approaching its all-time high set in May.

US Dollar Performance in the Past Week

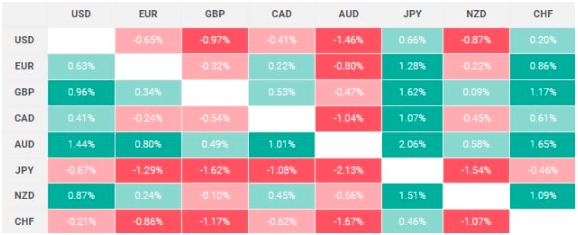

The following table shows the US Dollar’s performance against major currencies over the last week. The US Dollar saw its greatest strength against the Japanese Yen.

Conclusion

In summary, gold prices are currently being influenced by a combination of weakening US Dollar, global economic developments, and ongoing geopolitical tensions. As traders await critical US economic data and central bank decisions, the market remains cautious. For more detailed updates on gold market trends, you can visit our Daily Gold Signal page and explore our Daily Gold Update section for the latest insights.