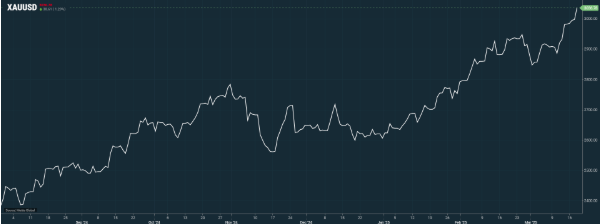

Gold prices surge to a historic high on Wednesday as rising tensions in the Middle East and uncertainties in global trade boosted the metal’s appeal as a safe-haven asset. Market participants are also closely monitoring the Federal Reserve’s upcoming decision on interest rates, adding to the market’s cautious sentiment.

Key Highlights for Gold Price:

- Spot gold increased by 1.29%, reaching $3,036.78 per ounce, after touching a record peak of $3,042.95 earlier in the session.

- U.S. gold futures saw a modest gain of 0.3%, trading at $3,048.70.

- Investors are closely watching the Federal Reserve’s policy meeting for cues on future interest rate decisions.

Market Context and Economic Factors

Amid heightened geopolitical uncertainties, particularly in the Middle East, investors have gravitated toward gold as a safeguard against volatility. The ongoing trade tensions and concerns over a possible economic recession due to U.S. tariffs have further bolstered the demand for gold. Analysts suggest that tariffs imposed by the U.S. government could lead to inflationary pressures, intensifying market instability.

Technical Insights

Spot gold’s current resistance level stands near $3,050 per ounce, while support is observed at $3,000. Analysts note that a dovish stance from the Federal Reserve could propel gold prices beyond this resistance, driving a further gold price surge if geopolitical risks persist.

According to Tim Waterer, Chief Market Analyst at KCM Trade, traders consider gold a resilient asset capable of managing economic uncertainty linked to tariffs. The current environment of instability is enhancing gold’s strength as a hedge against uncertainty.”

Anticipation of the Federal Reserve’s Decision

The Federal Reserve is expected to keep its benchmark interest rate steady at the 4.25% to 4.50% range. Should the Fed adopt a more cautious approach due to uncertainties surrounding tariffs and their potential impact on growth, gold prices could find further support. Market participants are also awaiting Federal Reserve Chair Powell’s speech, seeking additional guidance on future policy moves.

Broader Market Movement

Spot silver saw a slight increase of 0.1%, trading at $34.05 an ounce. Meanwhile, platinum fell by 0.4% to $993.45, and palladium edged up 0.1% to $968.20.

Conclusion and Outlook

With the Fed’s decision and ongoing geopolitical tensions, gold’s safe-haven appeal remains robust. Should the central bank lean toward a more accommodative stance, gold prices may break new records. Investors will continue to assess the evolving geopolitical landscape and economic policies to navigate potential market shifts.

For more insights on market updates, visit Daily Gold Signal. For detailed daily gold updates, explore this category.