Gold prices (XAU/USD) continue to rise, reaching a two-week high of around $2,375 during Thursday’s European session. This ongoing upward trend reflects market expectations that central banks, including the Federal Reserve, will lower interest rates to stimulate economic growth. As uncertainty looms over the global economy, gold remains a favored asset for investors seeking safety.

Recent Gold Price Movement

Gold prices have been on a bullish run, with expectations of interest rate cuts fueling the momentum. On Wednesday, the Bank of Canada made headlines by reducing its benchmark rate for the first time in four years, signaling concerns over a potential slowdown in economic activity. Meanwhile, the European Central Bank is anticipated to follow suit, with a rate cut expected during its June policy meeting.

In the United States, signs of an economic slowdown have increased the likelihood of an imminent rate cut by the Federal Reserve. This has kept U.S. Treasury bond yields at their lowest level in over two months, weakening the U.S. Dollar (USD) and boosting gold’s appeal. However, traders remain cautious as they await Friday’s U.S. Nonfarm Payrolls (NFP) report, which could significantly impact market sentiment.

Global Market Impact and Gold’s Appeal

Wednesday’s mixed U.S. macroeconomic data reaffirmed expectations that the Federal Reserve will begin cutting interest rates later this year. As a result, U.S. Treasury bond yields have continued to decline, providing support for non-yielding assets like gold. According to Automatic Data Processing (ADP), U.S. private sector employment increased by 152,000 in May, falling short of the forecasted 173,000 and the previous month’s adjusted figure of 188,000.

Additionally, the Institute for Supply Management’s (ISM) Services PMI rose to 53.8 in May, marking its highest level since August and surpassing expectations of 50.8. However, the Prices Paid sub-component dipped slightly to 58.1 from 59.2, indicating softer inflation pressures. The U.S. Personal Consumption Expenditures (PCE) Price Index, released on Friday, also pointed to easing inflation, further supporting gold prices.

The 10-year U.S. Treasury yield dropped to a two-month low of 4.28%, while the yield on the 2-year bond slipped to 4.731%. Despite a positive reaction from the U.S. Dollar, the decline in bond yields provided further upward momentum for gold, pushing it to a fresh weekly high during the Asian session on Thursday.

Key Economic Events to Watch

Investors are now focusing on upcoming U.S. economic data, including the Weekly Initial Jobless Claims report, for further market direction. However, the main event on everyone’s radar is Friday’s U.S. Nonfarm Payrolls (NFP) report, which could significantly impact the outlook for gold prices.

Technical Analysis: Resistance and Support Levels for Gold

From a technical perspective, momentum beyond the $2,364 level, last week’s high, could encourage bullish traders. However, mixed signals on the daily chart suggest caution before expecting further gains. As a result, gold prices may encounter strong resistance around the $2,400 mark. Should buying interest persist, the next key level to watch would be the $2,425 zone, with potential gains extending to $2,450, matching the all-time high reached in May.

On the flip side, a decline below the $2,360 level could attract fresh buyers near the $2,340 support zone. If prices dip further, the next significant support level lies between $2,315 and $2,314. A break below this range could lead to a deeper correction, with gold possibly testing the $2,280 level.

U.S. Dollar Performance: A Week in Review

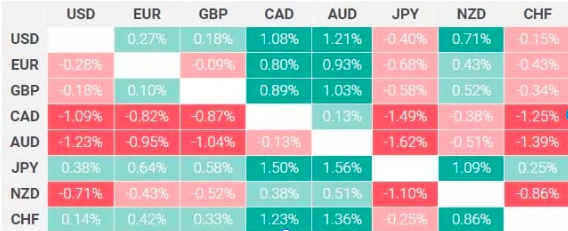

The table below showcases the percentage changes in the U.S. Dollar (USD) against major currencies over the past week. Notably, the U.S. Dollar struggled the most against the Swiss Franc. The heatmap illustrates percentage fluctuations among major currencies, with the left column representing the base currency and the top row showing the quote currency.

Conclusion: Stay Informed on Gold Market Trends

Gold prices are influenced by a range of factors, including central bank policies, U.S. economic data, and global market sentiment. As uncertainty continues to shape the market, staying informed is crucial for investors.

For daily updates on gold prices and market analysis, visit our internal link here. For more detailed reports, check out our external link here.