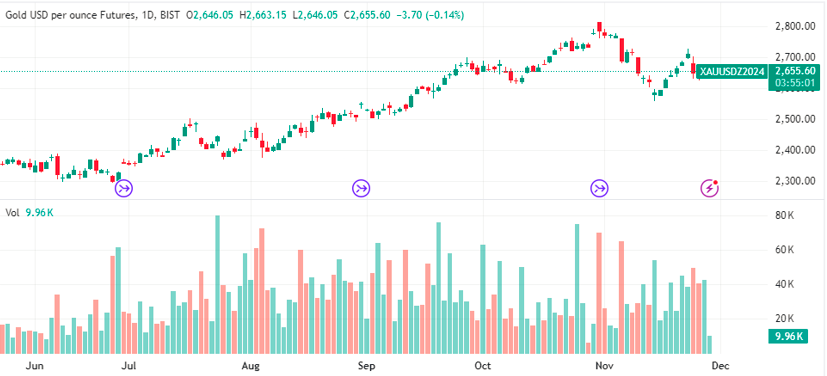

Gold price trends (XAU/USD) has shown a slight recovery, continuing its upward trajectory as markets anticipate a Federal Reserve (Fed) interest rate cut in December. The yellow metal’s appeal grows with the likelihood of lower rates, making it an attractive choice for investors seeking stability. However, geopolitical developments could cap these gains in the short term.

Gold prices are on a modest upward trend, driven by expectations of the Fed reducing interest rates. This potential move benefits gold by lowering the opportunity cost of holding non-yielding assets. At the same time, recent geopolitical developments, including a temporary truce in the Middle East, provide mixed signals for gold’s price movement.

Gold Benefits from Rate Cut Hopes

Gold price trends recovery is fueled by increasing market confidence in a December rate cut. The probability of a 25-basis-point (bps) rate reduction surged to 70% on Thursday, compared to 55%-66% earlier, based on the CME FedWatch tool. A Fed rate cut typically supports gold, as it reduces yields on competing investments, making the metal more desirable.

Geopolitical Tensions and Their Impact

Gold’s upward momentum faces resistance due to easing geopolitical risks. Israel and Hezbollah’s recent 60-day ceasefire is seen as a positive development. However, experts remain skeptical, citing unresolved conflicts in Gaza that could reignite tensions.

Technical Analysis: Gold’s Trendline Offers Insights

Technically, gold remains within a long-term uptrend. The precious metal has consistently traded above a significant trendline. Breaking above $2,721, Monday’s high, could signal further gains toward the $2,790 mark. Conversely, a sustained drop below the trendline might confirm a short-term bearish trend, potentially pushing prices to November lows of $2,536.

Trade and Tariff Developments Add Context

US-Mexico trade relations have also impacted market sentiment. Former President Trump recently proposed a 25% tariff on imports from Mexico and Canada to address border and drug-related concerns. While the tariffs initially raised inflation fears, Trump’s softened stance has brought some relief. This diplomatic maneuvering highlights the complex interplay between trade policies and gold’s price movements.

Conclusion

Gold continues its recovery, supported by the Fed’s potential interest rate cut and ongoing geopolitical events. Investors should monitor key technical levels and market updates to navigate future price trends effectively. For more detailed updates on gold prices, check the Daily Gold Signal and visit the Daily Gold Update for external insights.