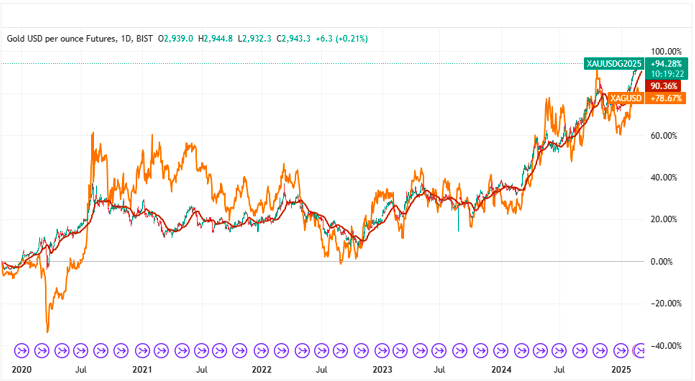

Gold prices (XAU/USD) touched a historic high of 2,956 on Monday but has since pulled back, trading around 2,956 on Monday but has since pulled back, trading around 2,940 on Tuesday. The dip comes as the US government announces plans to impose stricter controls on China’s semiconductor industry. This move is part of a broader strategy to limit China’s technological advancements, particularly in AI and defense sectors.

The announcement has sparked a risk-off mood in global markets. Investors are shifting to safer assets like bonds, pushing yields lower and causing equity markets to tumble. With limited economic data on Tuesday, attention is turning to Federal Reserve speeches and Friday’s Personal Consumption Expenditures (PCE) report.

Key Takeaways:

- Gold prices peaked at 2,956 before falling to 2,956 before falling to 2,940.

- The US plans stricter semiconductor export controls on China.

- Bond yields drop as investors seek safety, while equities decline.

- Markets await Fed speeches and the PCE report for policy direction.

Geopolitical Tensions Impact Gold Prices Amid Semiconductor Restrictions

The US government is ramping up efforts to restrict China’s access to advanced semiconductor technology. According to Bloomberg, the goal is to hinder China’s ability to develop a self-sufficient chip industry, which could bolster its AI and military capabilities.

This escalation in tensions has rattled global markets. Investors are flocking to bonds, causing yields to drop. Meanwhile, equity markets in Asia, Europe, and the US are experiencing significant losses.

Technical Analysis: Key Trends in Gold Prices

Gold’s price action on Tuesday indicates a bearish tone. The metal briefly fell below the daily pivot point of $2,943, signaling selling pressure. Despite attempts to recover during Asian trading, buyers struggled to maintain upward momentum.

Critical Levels to Monitor:

- Support Levels:

- S1: $2,930 (Monday’s low in the US session).

- S2: $2,908 (next major support).

- Resistance Levels:

- R1: $2,964 (immediate resistance).

- R2: $2,977 (secondary resistance).

A break below S1 could see prices testing the 2,900 level. Conversely, surpassing the all−time high of 2,900 level. Conversely, surpassing the all−time high of 2,956 could open the door for further gains.

Market Drivers and Fed Outlook

The CME FedWatch Tool shows a 50% probability of a 25-basis-point rate cut in June, up from previous estimates. This shift follows the decline in US yields on Tuesday. Investors are also eagerly awaiting Friday’s PCE report, which is expected to show easing inflation.

Upcoming Fed Speeches:

- Michael Barr (Fed Vice Chair): Discussing financial stability at 16:45 GMT.

- Tom Barkin (Richmond Fed President): Speaking on inflation at 18:00 GMT.

- Lorie Logan (Dallas Fed President): Addressing central bank balance sheets at 21:15 GMT.

These speeches may provide further clarity on the Fed’s monetary policy stance.

Conclusion: Navigating Gold’s Next Moves

Gold’s recent price action reflects the interplay of geopolitical tensions and shifting Fed expectations. While the metal remains a safe-haven asset, its short-term direction hinges on key technical levels and upcoming economic data.

For daily updates on gold prices and market trends, visit Daily Gold Signal. For more insights on gold market trends, check out Daily Gold Updates.