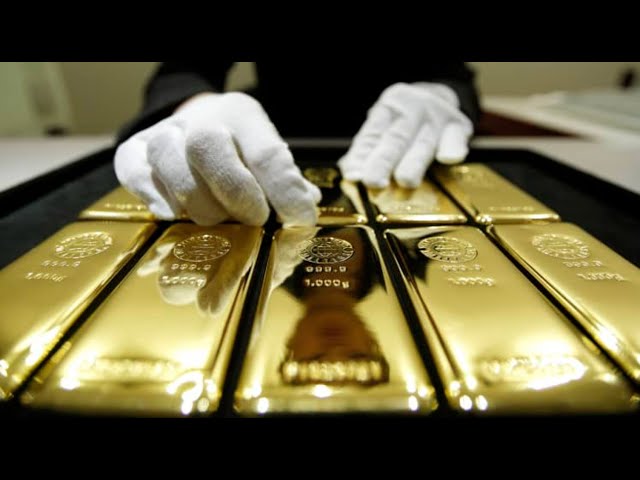

Gold prices in India remained stable on Wednesday, according to FXStreet. The price for gold was INR 6,220.17 per gram, showing minimal change from INR 6,225.89 on Tuesday. Similarly, the gold price per tola was steady at INR 72,550.85, compared to INR 72,617.53 the previous day.

1. Current Gold Prices

Here is a detailed look at the current gold prices in various units of measure:

Unit Measure | Gold Price in INR

- 1 Gram: 6,220.17

- 10 Grams: 62,201.71

- Tola: 72,550.85

- Troy Ounce: 193,469.10

2. Price Calculation Method

FXStreet calculates gold prices in India by adjusting international prices (USD/INR) to the local currency and measurement units. This ensures accurate and up-to-date pricing that reflects both global market conditions and local economic factors.

3. Daily Updates and Market Rates

The prices are updated daily based on market rates at the time of publication. This provides a reliable reference for investors and consumers. However, it is important to note that local rates may vary slightly due to various factors.

4. Importance of Gold Prices

Monitoring gold prices is crucial for investors, jewelers, and consumers. It helps in making informed decisions regarding buying, selling, and investing in gold. Stable prices indicate a balanced market, while fluctuations can signal changes in demand and supply dynamics.

5. Gold Price Trends

Understanding the trends in gold prices can offer insights into the broader economic conditions. For instance, stable gold prices might suggest stability in the currency exchange rates and global economic conditions. Conversely, significant changes can indicate market volatility or economic shifts.

6. Gold as an Investment

Gold is often considered a safe-haven investment. It retains value over time and provides a hedge against inflation. Investors closely watch gold prices to time their purchases and sales for maximum returns. The steady prices observed today might attract long-term investors looking for stability.

7. External Influences on Gold Prices

Several factors can influence gold prices, including geopolitical events, economic data releases, and changes in currency values. For example, tensions in major gold-producing regions or significant policy changes by central banks can lead to price fluctuations.

8. Future Projections

Experts often use current price data to predict future trends. Stable prices might indicate a period of calm in the gold market. However, it’s essential to stay informed through reliable sources to understand potential future movements.

For more information and updates on gold prices, visit the Daily Gold Signal. For daily updates, check out their daily gold update section for the latest trends and changes in the gold market.