Precious metals stall amid USD strengthening have recently lost some momentum due to a strengthening US Dollar (USD). Ryan McKay, Senior Commodity Strategist at TDS, shares insights on this trend.

Economic Data Impact On Gold Appetite

Traders are closely monitoring various economic indicators. This week’s economic data could significantly impact the appetite for Gold (XAU/USD).

Inflation Trends and Their Impact on Precious Metals Amid USD Strengthening

The Personal Consumption Expenditures (PCE) data is highly anticipated. Following the lower-than-expected Consumer Price Index (CPI) and Producer Price Index (PPI) data, the core PCE segment is projected to rise at its slowest monthly rate this year, around 0.13%. Further indications of easing inflation could solidify the Federal Reserve’s potential rate-cutting trajectory. Influencing the precious metals stall amid USD strengthening.

Limited Downside Risks

Conversely, the downside risk appears limited even if economic data exceeds expectations. Commodity Trading Advisors (CTAs) maintain a buffer above $2,200 per ounce, preventing significant selling pressure. Moreover, ongoing physical demand from central banks and Asian markets continues to support the precious metals market.

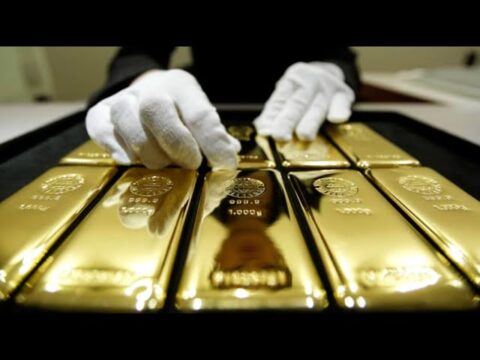

The Role of Central Banks

Central banks play a crucial role in sustaining the gold market. Their continuous accumulation of gold reserves adds a layer of stability and support.

Asian Market Influence

Asian countries, known for their strong demand for precious metals, contribute significantly to the market’s resilience. Their consistent buying patterns help mitigate the impact of a stronger USD.

Conclusion

The interplay between economic data, inflation trends, and global demand shapes the dynamics of the precious metals market. Keeping an eye on these factors is essential for understanding market movements.

For more insights, visit Daily Gold Signal. Explore our daily gold updates for the latest trends and analysis.